The Pandemic and Tech Adoption: Should Your SMB Invest in an ERP?

Because of the pandemic, we may never return to the business-as-usual we used to know. But that’s not necessarily a bad thing. With social distancing mandates and government-set lock downs, many businesses have broken through innovation barriers at an unprecedented pace, especially when it comes to more rapidly selecting, implementing, and adopting technologies that save time and money and improve operational efficiencies.

But if you’re a small-to-medium sized business (SMB), you may wonder just exactly where you should target your investments. Everyone these days seems to have a solution for a work process. Departments and employees often make so many recommendations to senior leadership that it gets too hard to weed through them all, especially if you have a limited budget.

Salesforce’s Small and Medium Business Trends report, for example, points out that SMBs that embrace technology and that are “digital-forward” may be a key differentiator in dealing with market volatility, and technology plays an important role in influencing successful operations.

Here are a few highlights:

- 51% of respondents said technology drives customer interactions, which is important to note because almost half of respondents (48%) also said that due to the pandemic, contactless service options (i.e. digital commerce, mobile orders, etc.) are now areas of focus

- 46% say technology influences an SMB’s ability to stay open and operational

- 42% say tech drives customer growth

- 40% say it drives employee productivity

- 32% say it drives collaboration

But having technology at hand doesn’t necessarily contribute to operational resiliency. It’s about having the right technology to meet your organization’s unique needs — and ensuring that it can scale with you as you face new challenges and grow your services and offerings.

Unfortunately, as small businesses evolve into mid-size, and mid-size businesses grow into large enterprises, those technology stacks can grow larger and often increasingly disparate.

This leads to data that is siloed within one department, location, or sometimes, even with just a single employee.

The good news is, however, that an increasing number of businesses and their leaders are seeing the value of cutting the cord on so many disparate systems and instead unifying the operational core with a single solution that integrates cross-business functions.

According to that Salesforce survey, 72% of SMB leaders think a centralized application that tackles all core operations is helpful – and a growing number of businesses are actually decreasing the total number of applications they’re using as they move toward more technology consolidation. In March 2019, for example, the report estimates that on average an SMB used 5.2 applications for operations, compared to 4.6 in August 2020.

That push for consolidation goes hand-in-hand with the pandemic-push for technological efficiencies, where at least a quarter of SMB leaders are making more investments in tech.

When it comes to narrowing that technology stack, here are some of the key things the survey respondents said they were looking for when they’re considering a new technology:

- 74% Ease of use

- 73% Vendor trust

- 71% Price

- 67% Customer experience impact

- 66% Easy to maintain

And here are some of the many ways SMBs are using technology to streamline operations for customer relationship management (CRM):

- Email marketing

- Customer service

- Project management

- E-commerce

- Marketing automation

If you’re an SMB and you’re on your journey to streamline technological efficiencies without increasing the number of systems and software you need, where do you start? You may be surprised to know there’s one tool out there that can handle all of your needs — an enterprise resource planning (ERP) solution.

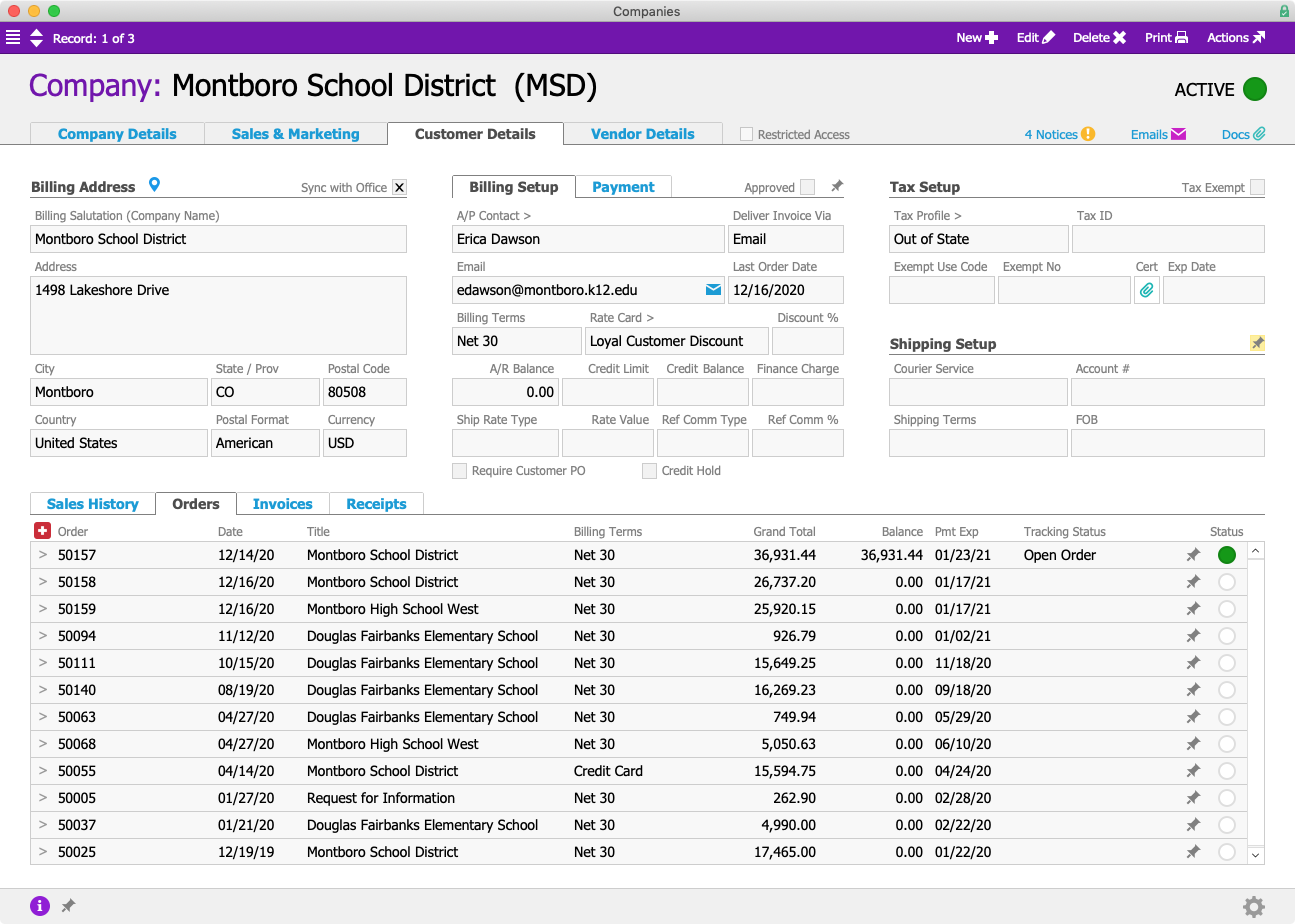

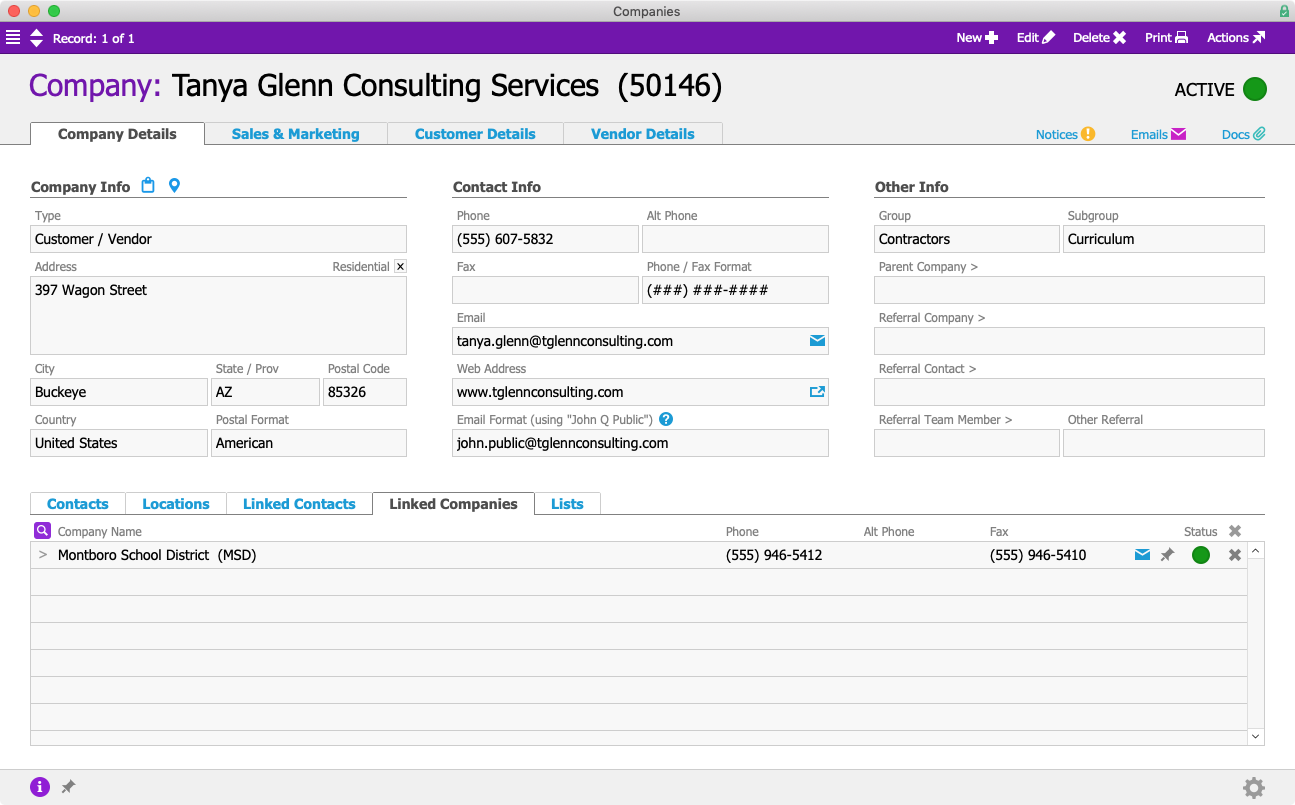

An ERP is software that your business can use to manage operations, from inventory and production, to back-office tasks like customer management, billing, human resources, accounting, and more. And ERPs are no longer just for big enterprises. There are an increasing number of advantages and cost savings for SMBs who put an ERP to work for them.

Here are a few benefits of investing in an ERP:

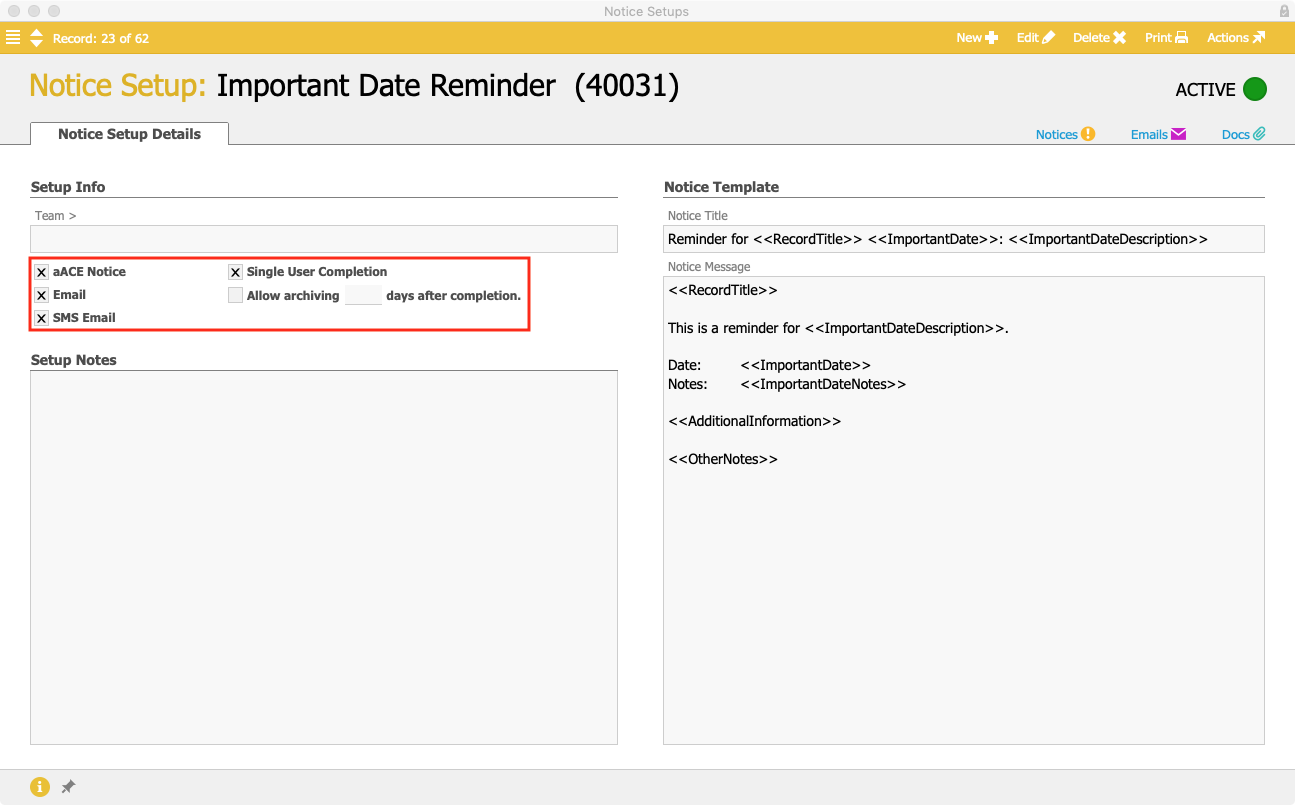

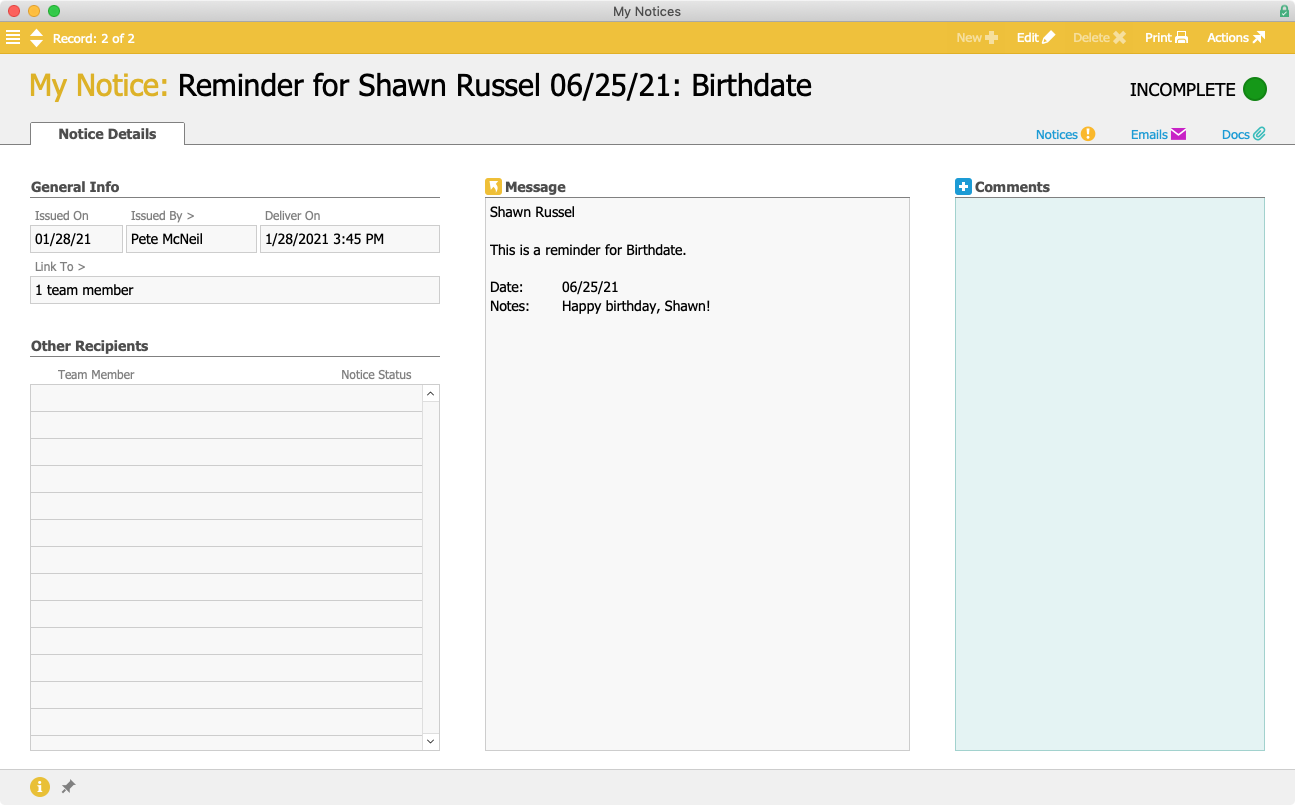

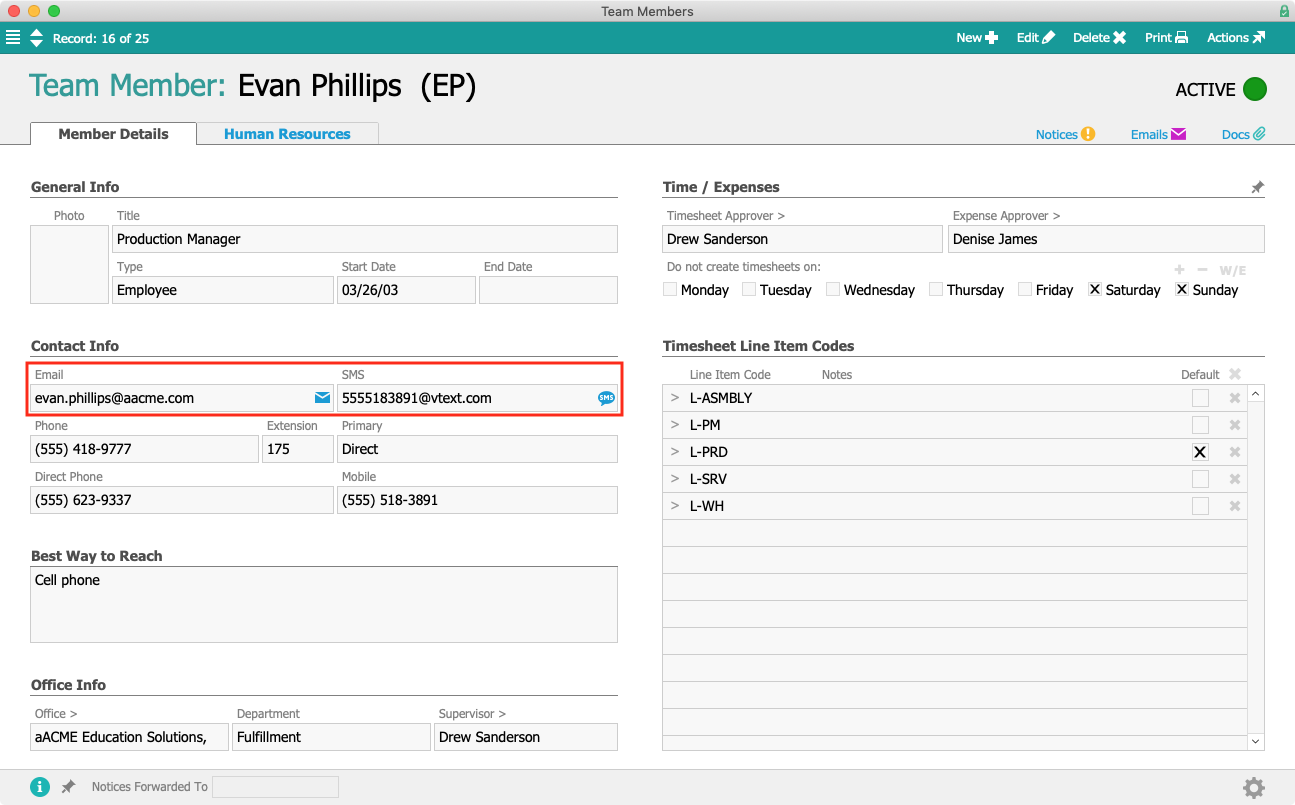

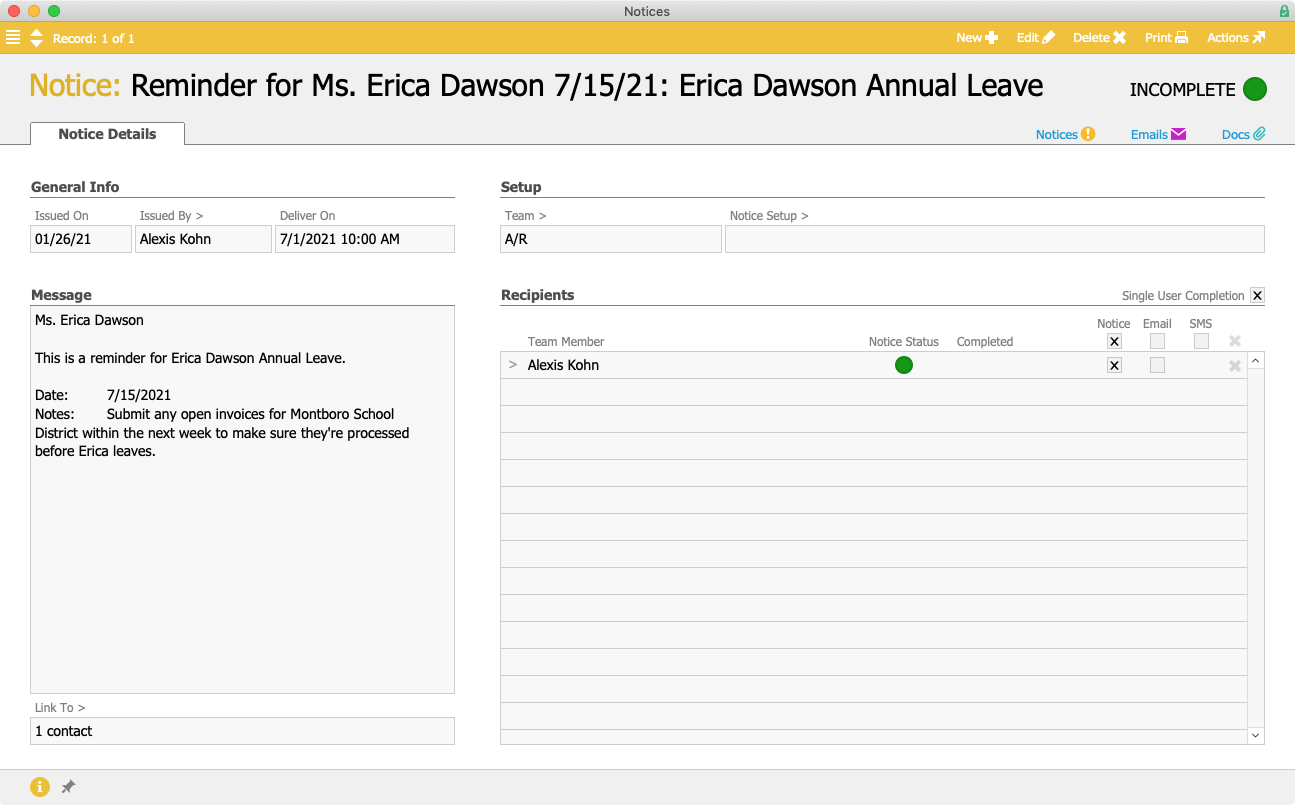

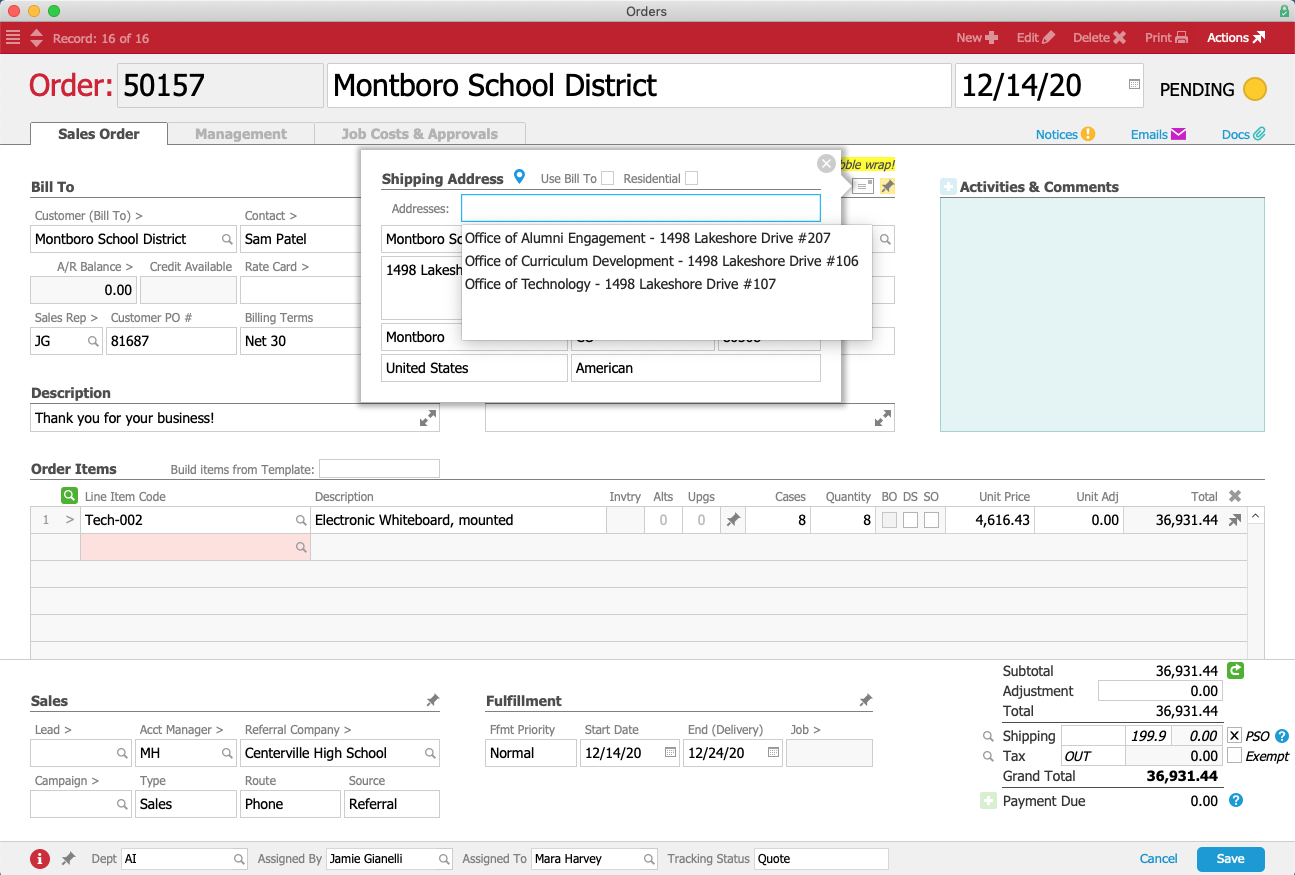

- Task and workflow automation that removes the need for manual, repetitive data entry across multiple applications

- Decreased human errors and increased data integrity

- Confidence that your ERP follows approved processes and procedures

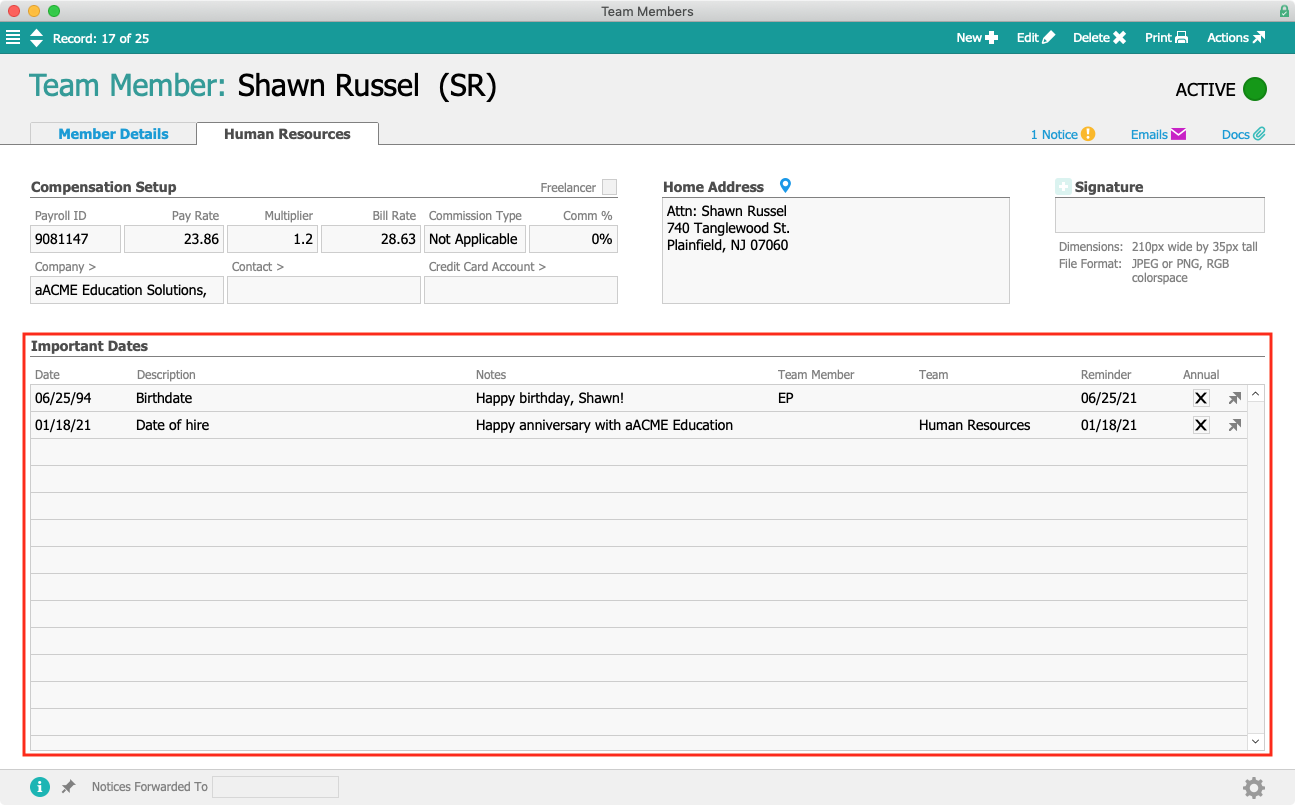

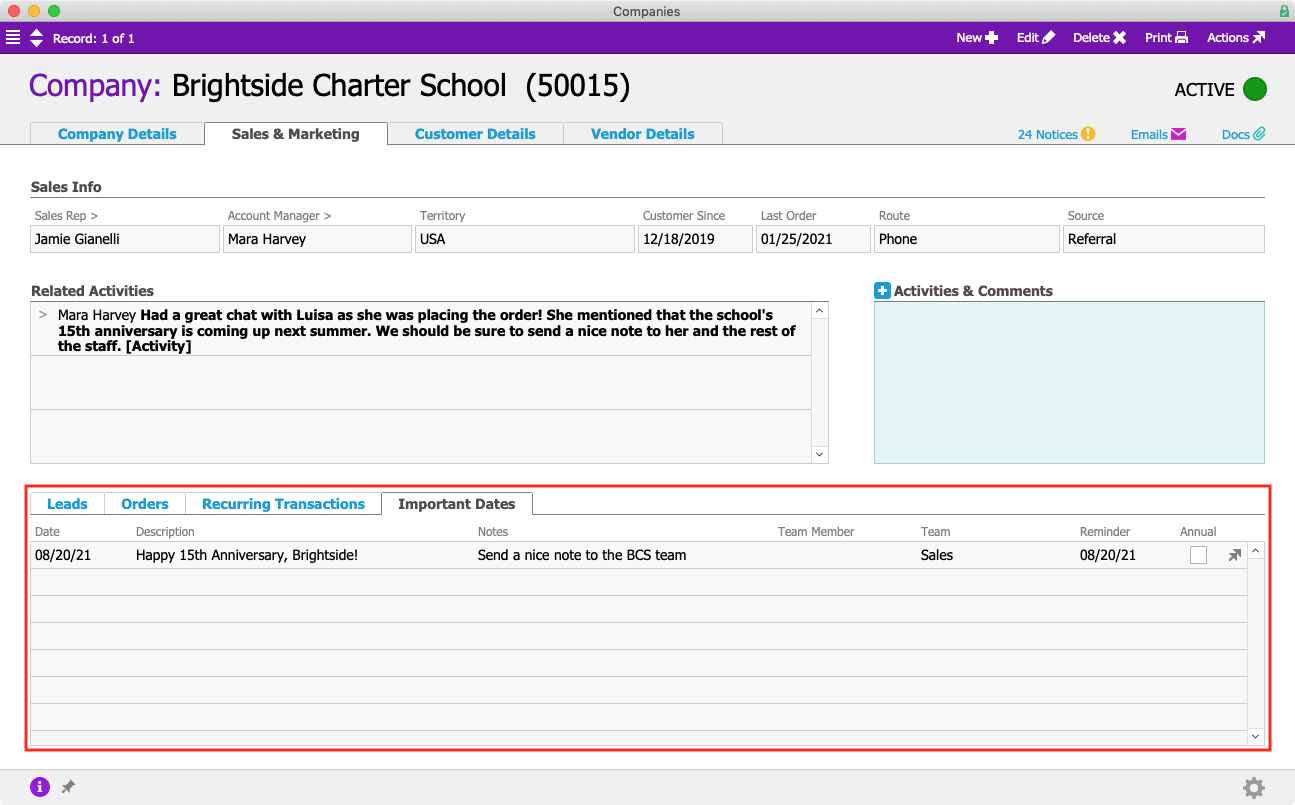

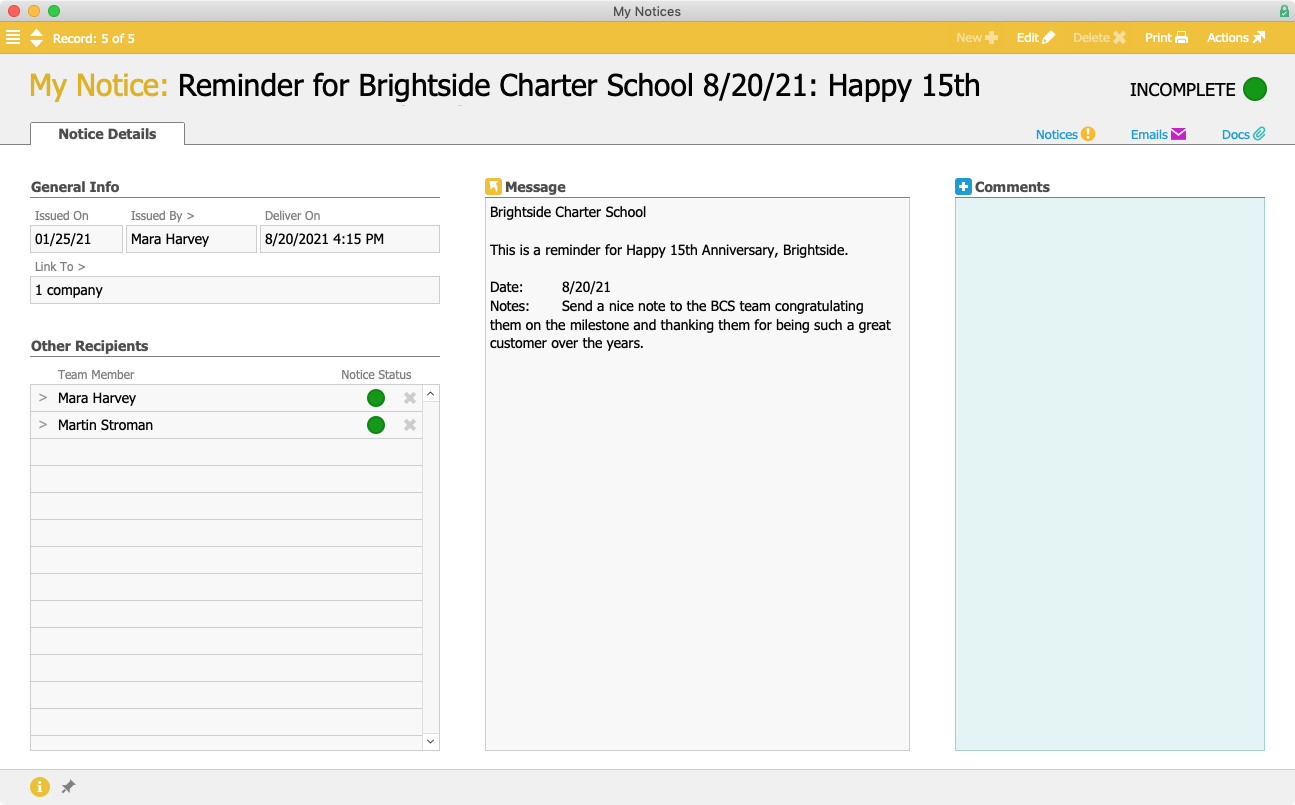

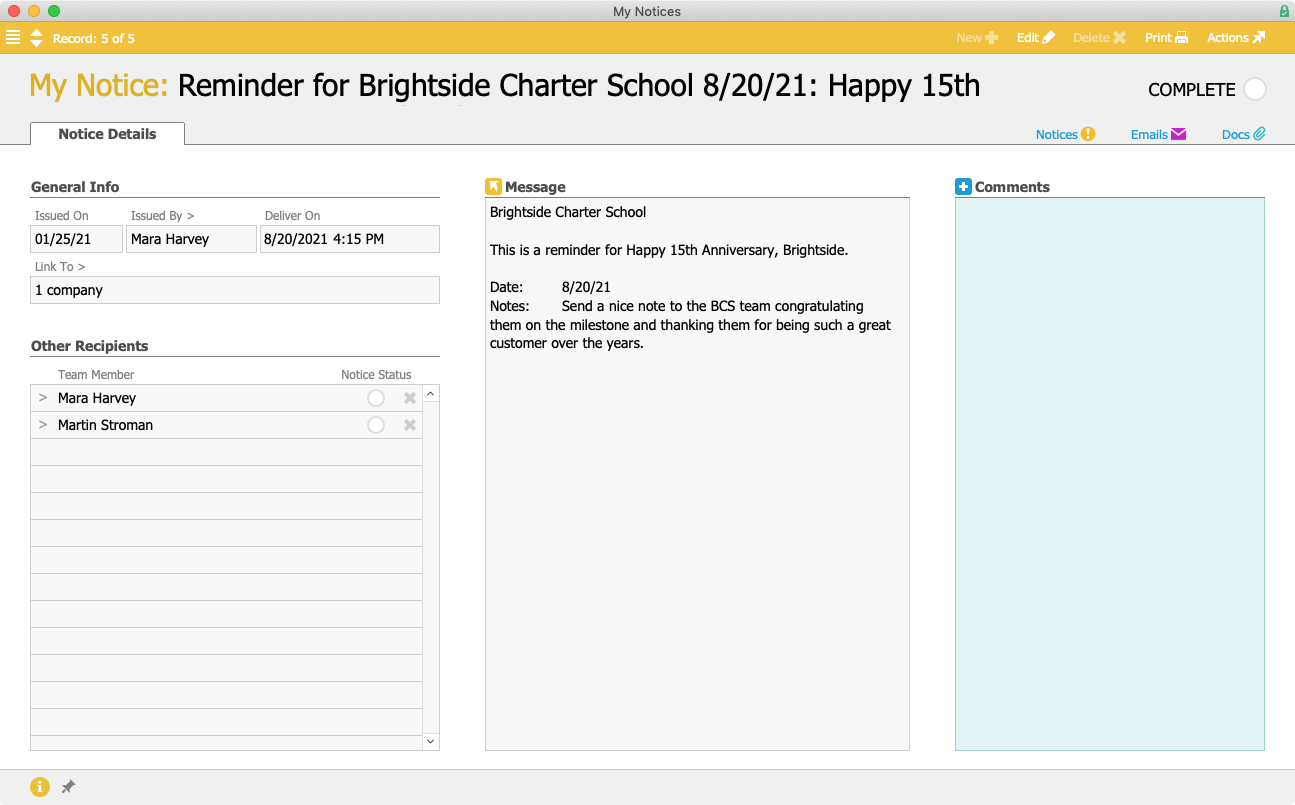

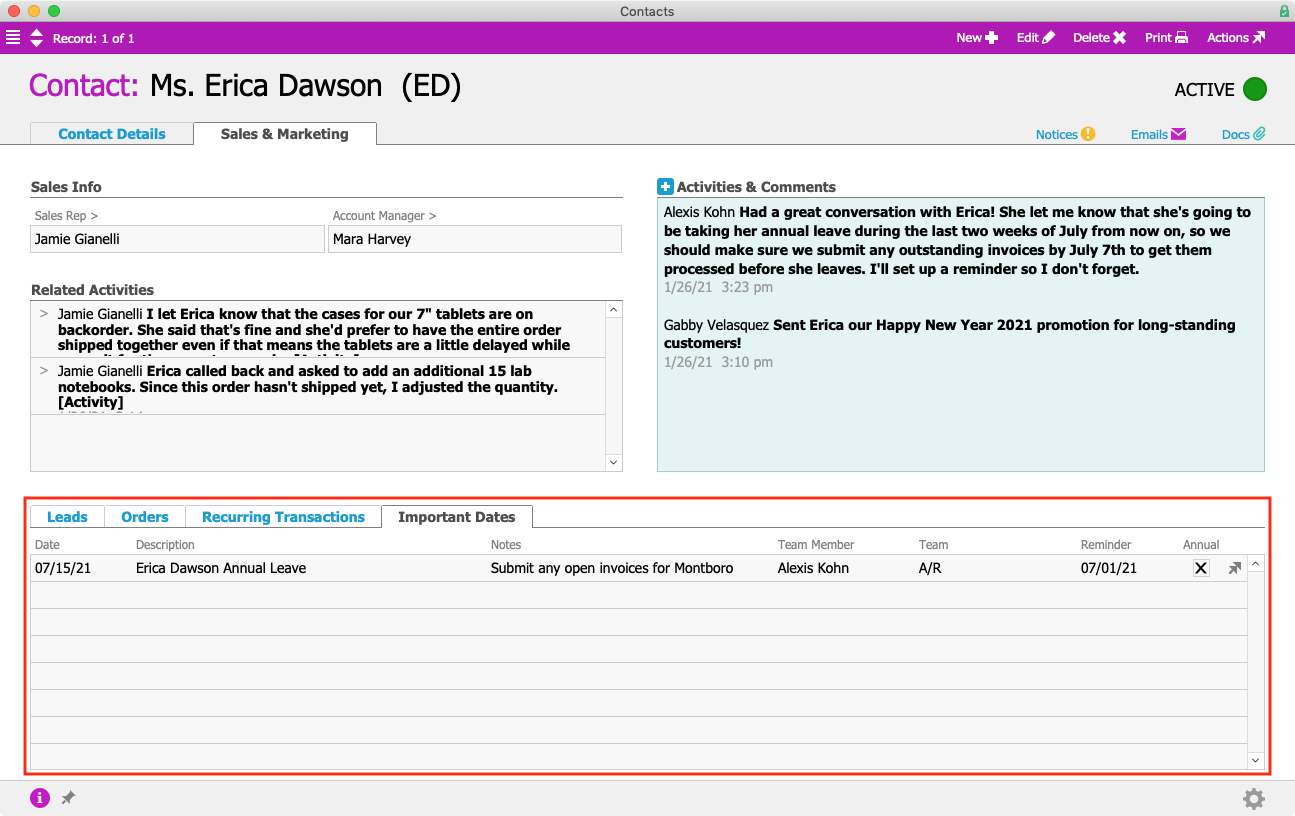

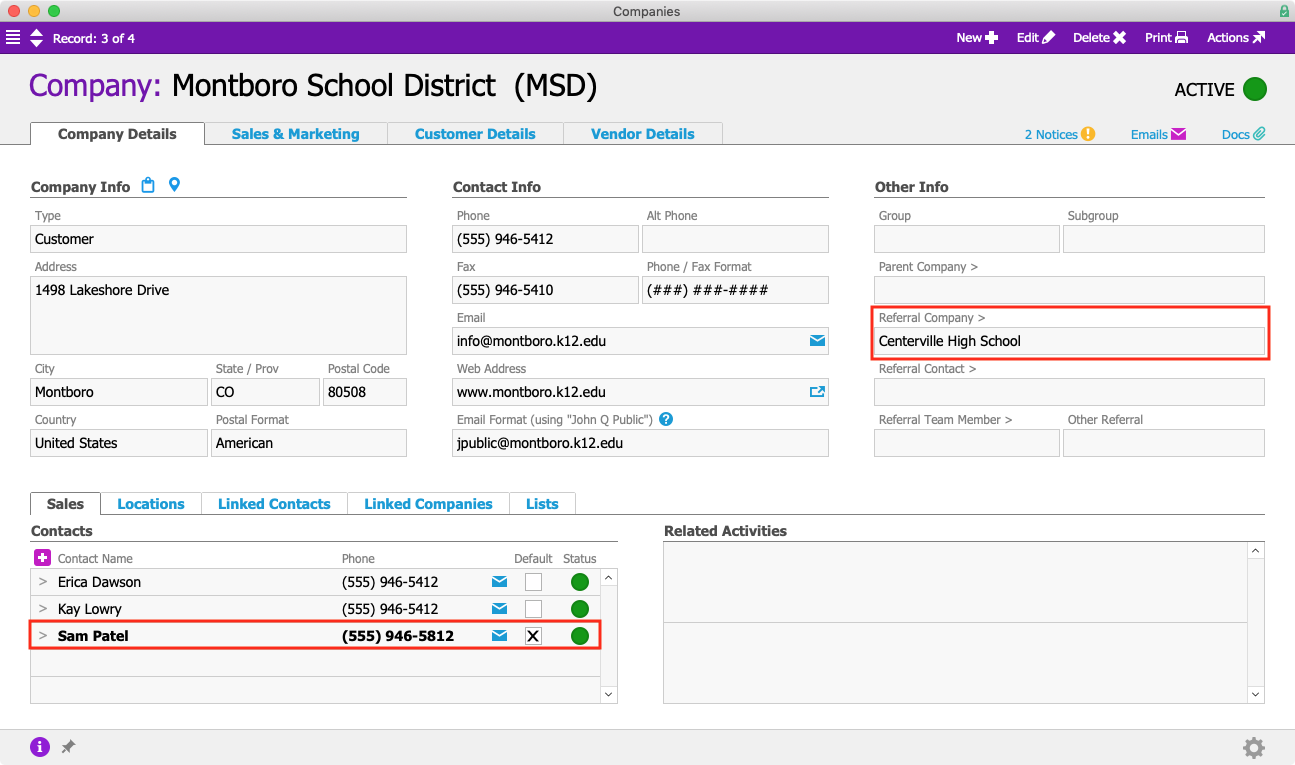

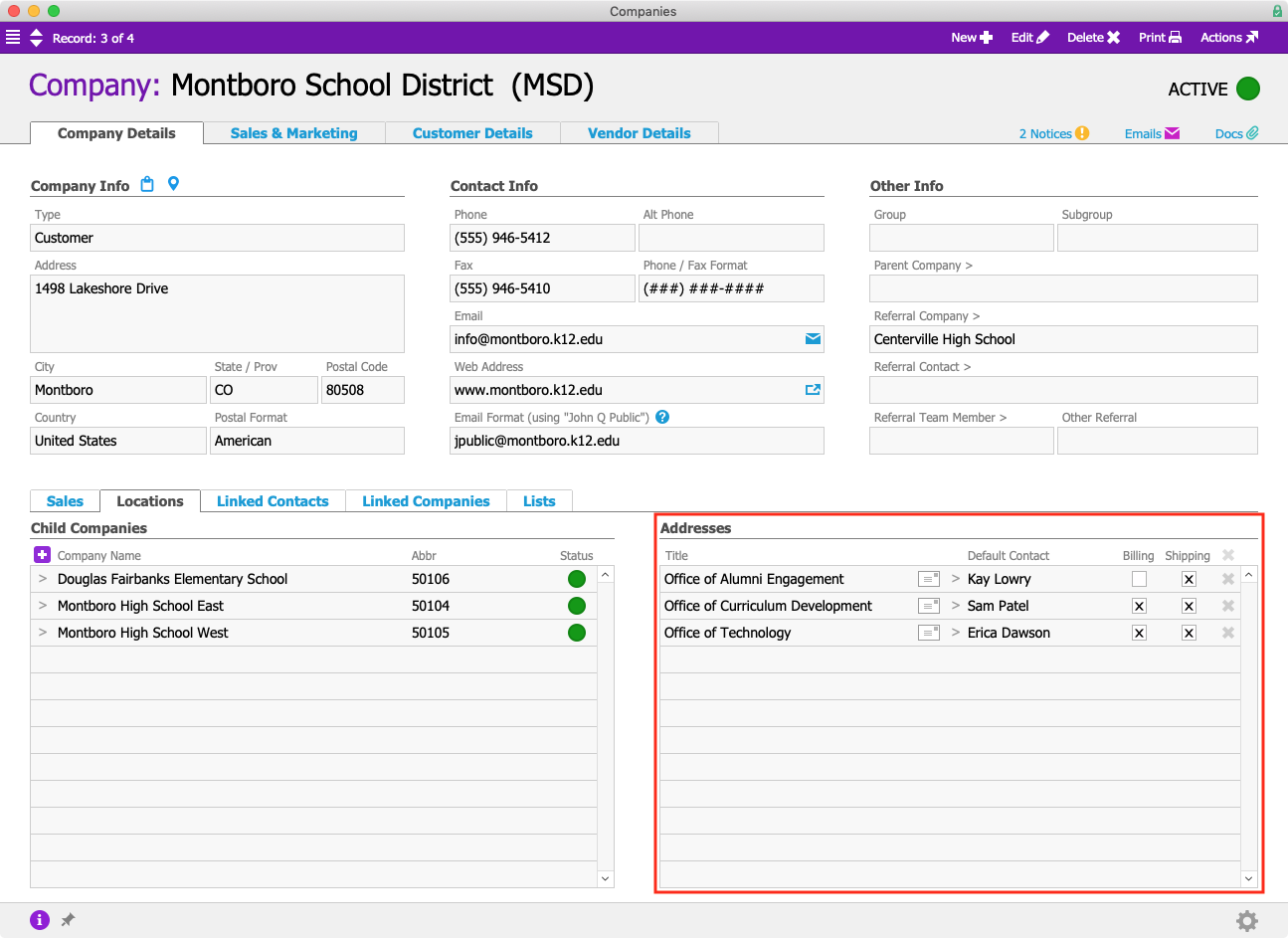

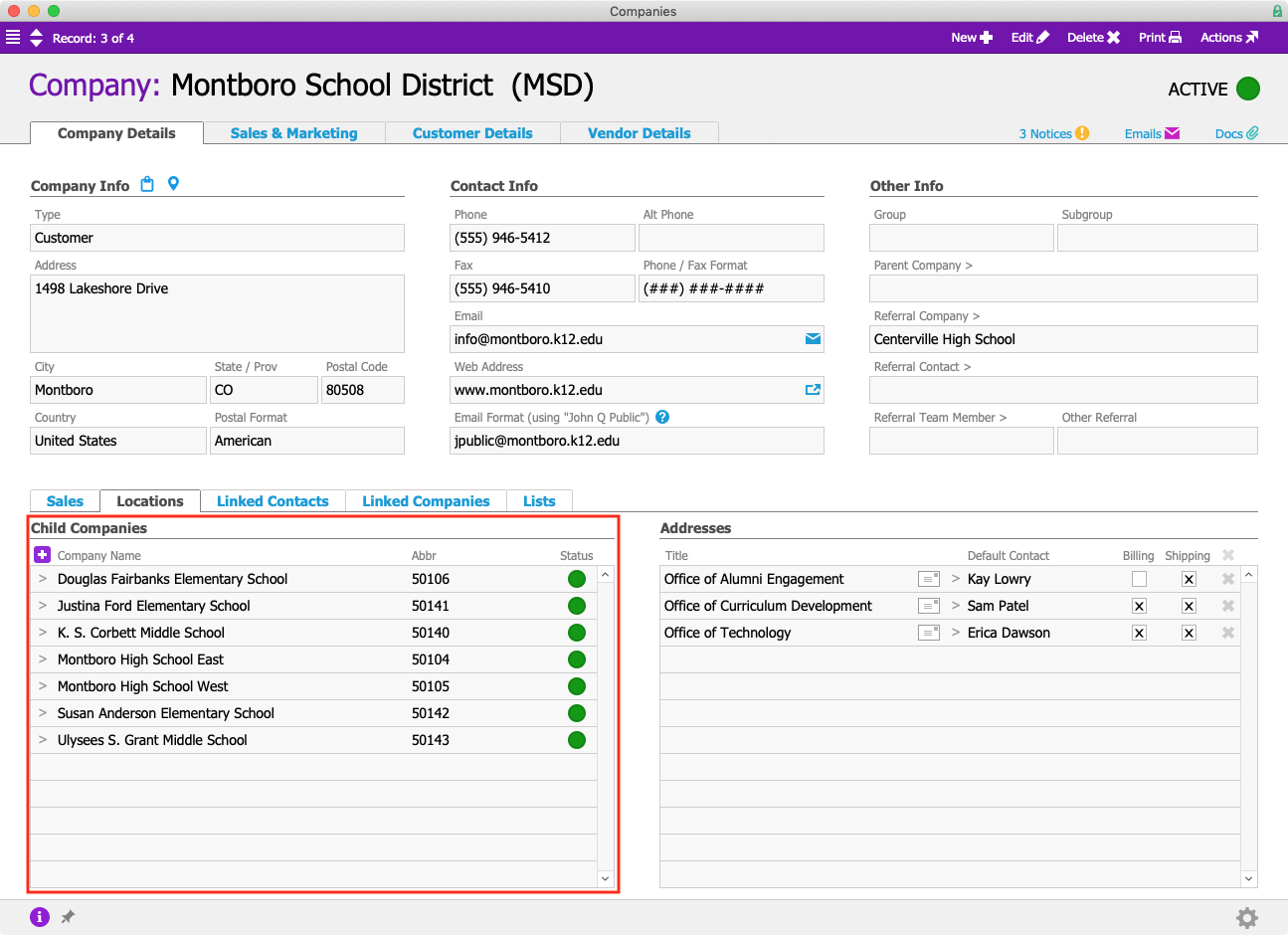

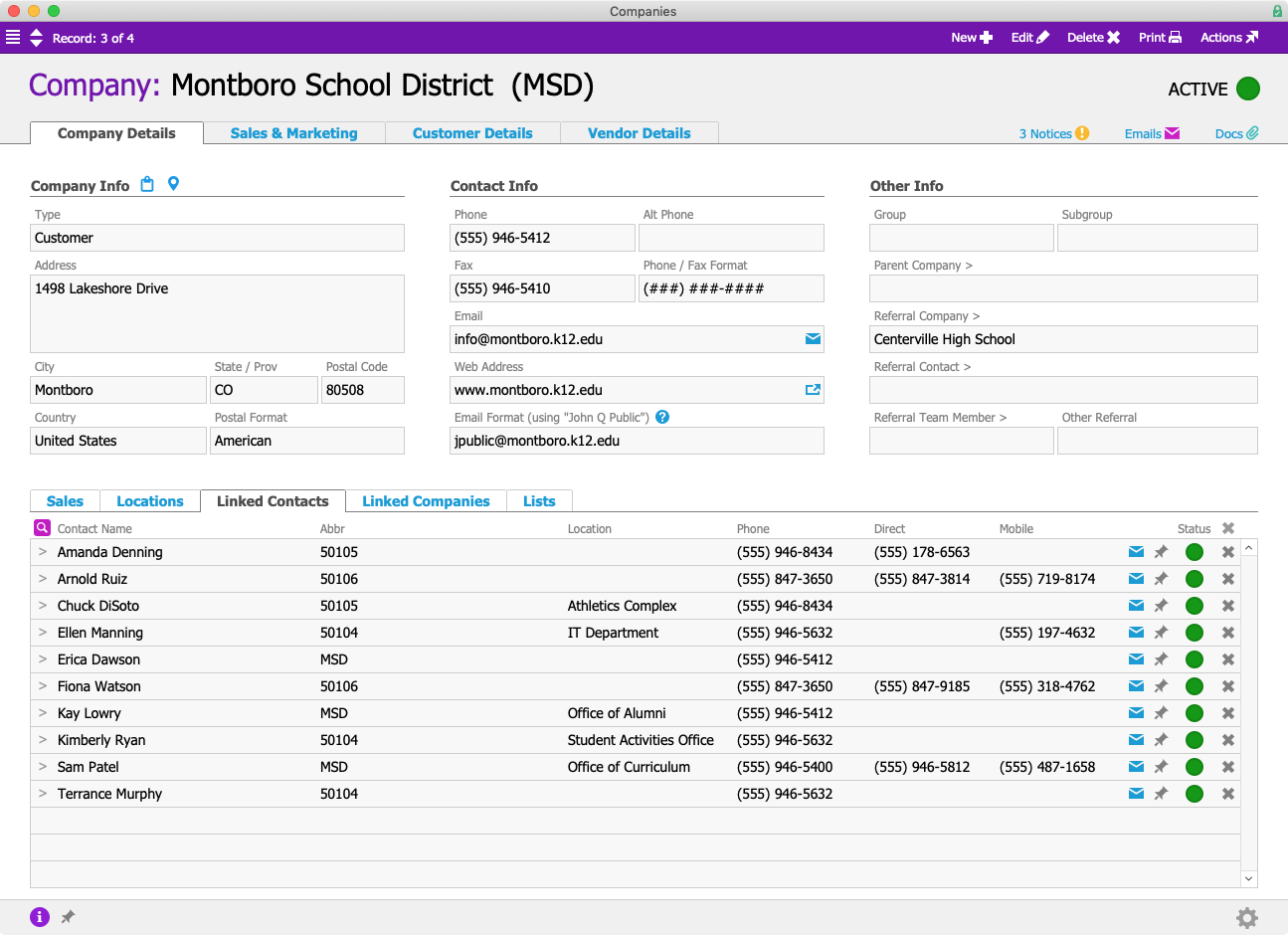

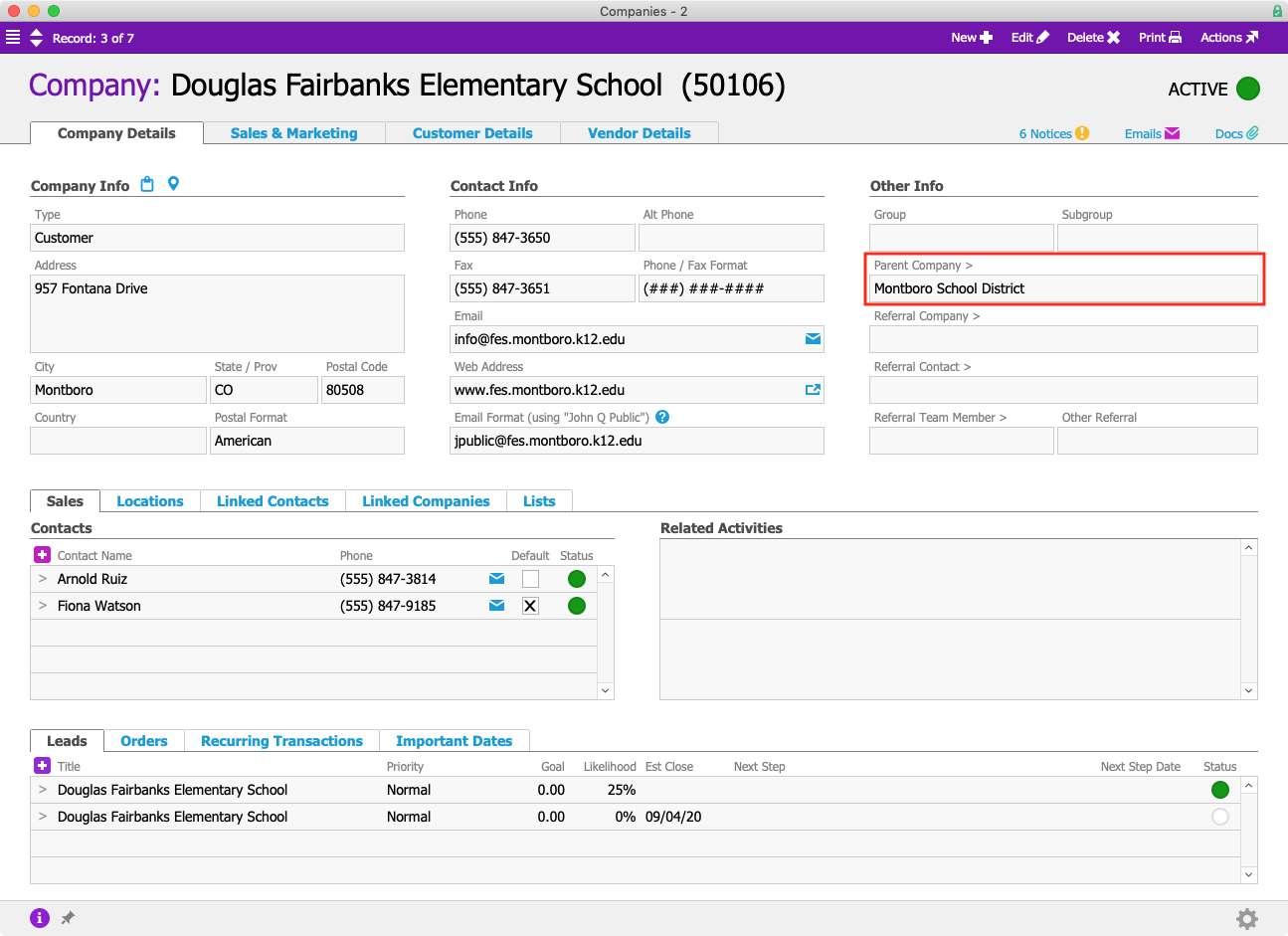

- Elimination of data silos across your organization so the right people can access the data they need, when they need it, in near real-time to make better data-driven business decisions

- Increased efficiencies by letting the system automation handle certain workflows so your people can focus on more important tasks

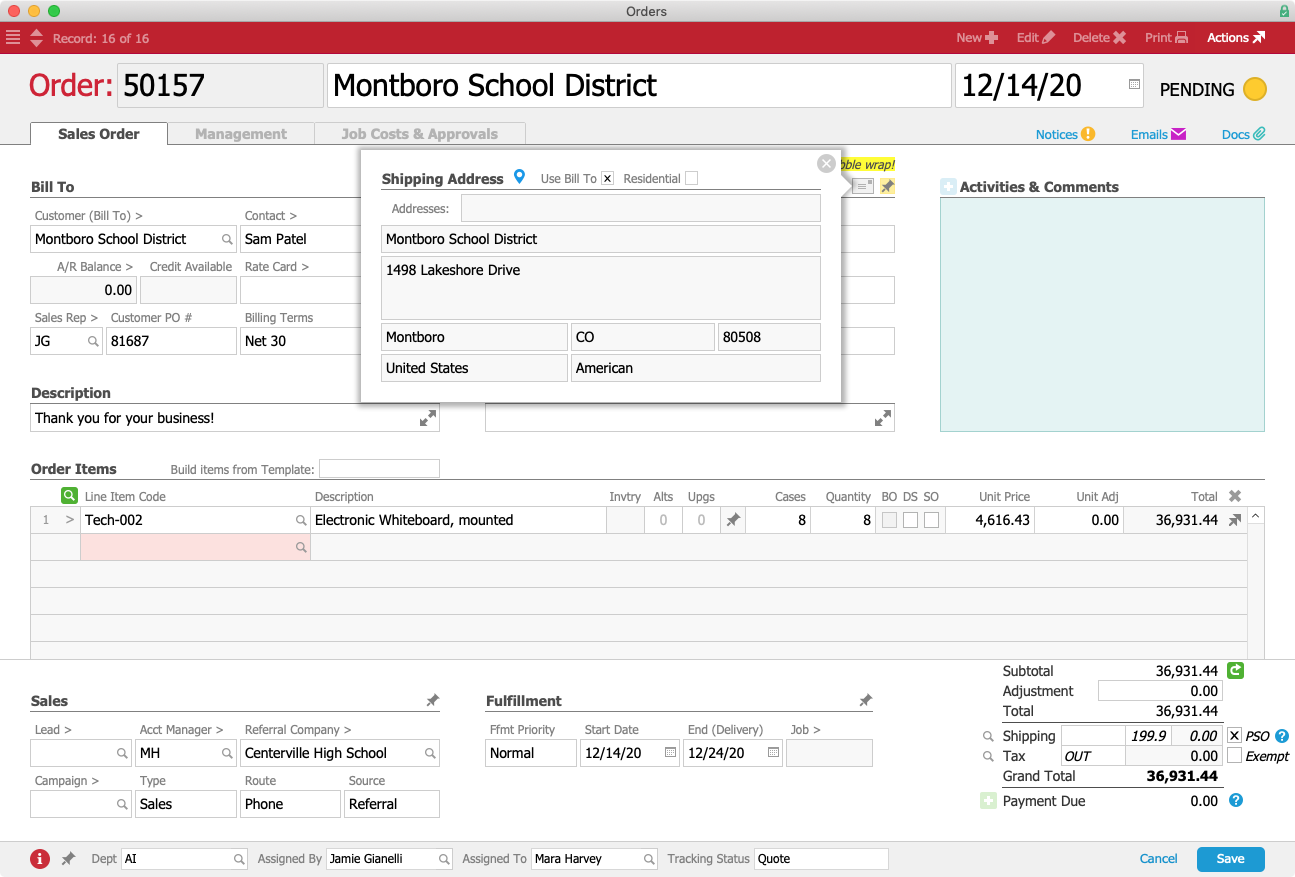

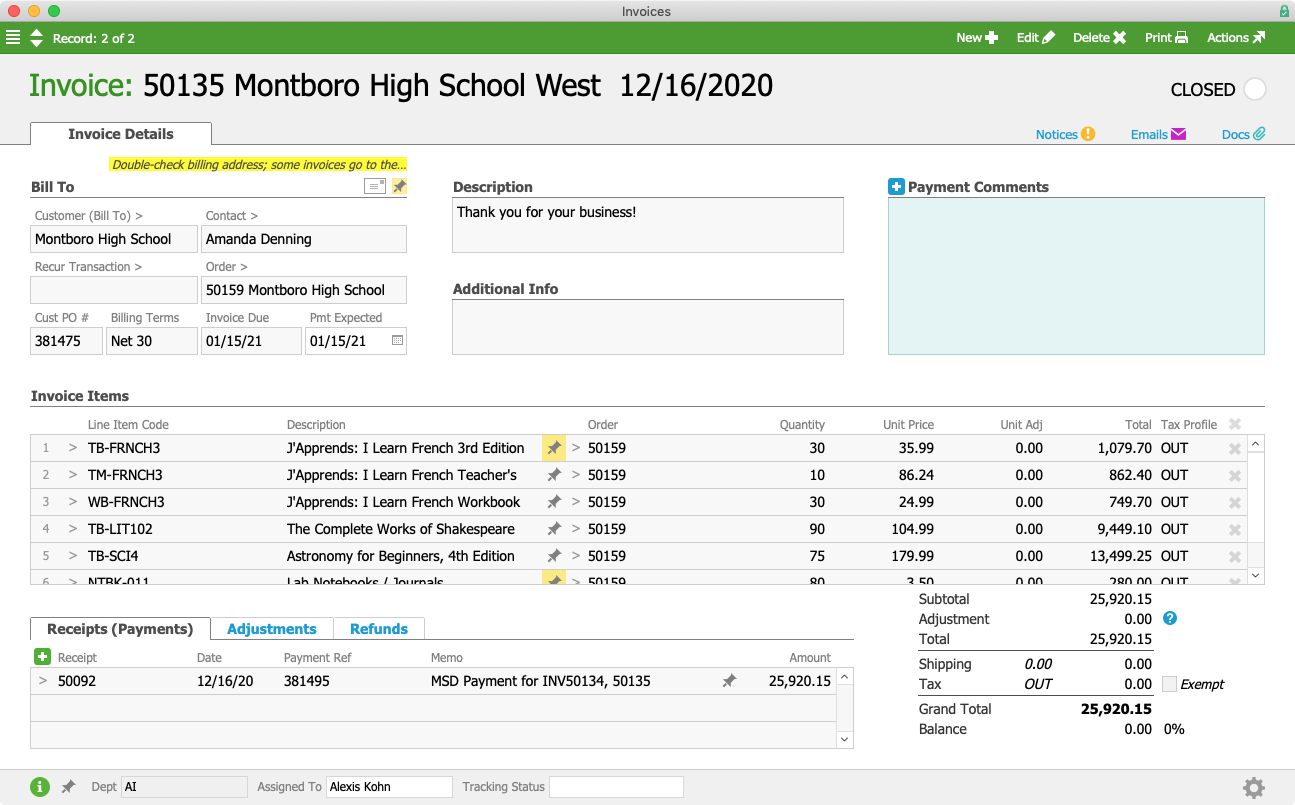

- Increased visibility into your sales process, from marketing lead to customer

- Better inventory and product management

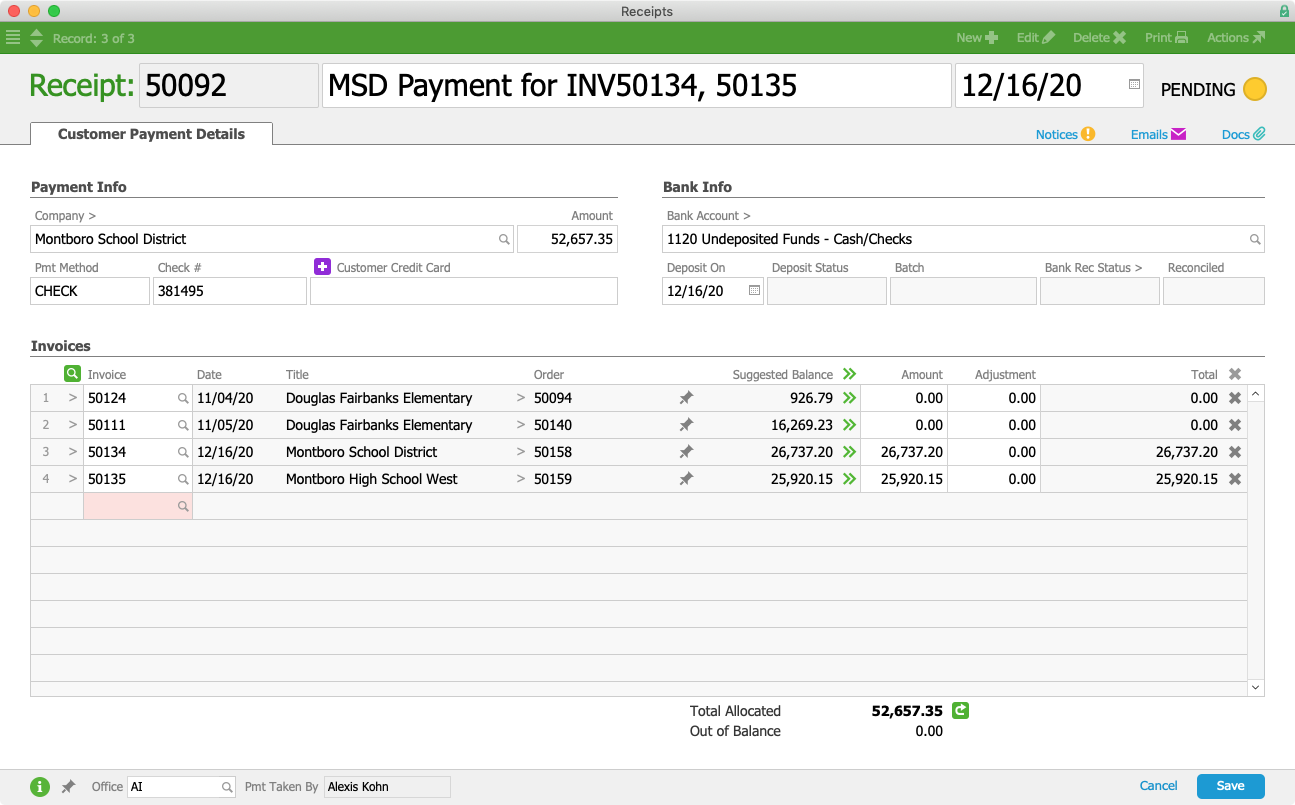

- Streamlined invoicing, billing, and accounting processes

- Faster order processing

- Timely and accurate budgets and sales forecasts

- Improved tracking of benchmarks and KPIs, and customizable reports to ensure you always know how you’re doing and where you need improvements

- Insight to forecast potential issues, for example supply chain disruptions or product back-order, before a problem compounds

- Happier customers with improved customer experiences

- Simplified integration across a variety of systems and applications

These are some of the many benefits of using an ERP for your SMB. If you’re a small or mid-sized business and you’re not sure if now is the right time to invest in an ERP, register for an aACE webinar today and we’ll show you how an ERP can transform your business, save you money, and improve efficiencies.