Managing sales taxes isn’t anyone’s idea of a good time — but it doesn’t have to be a chore, either. aACE’s out-of-the-box tax management infrastructure makes it easy for you to set and update tax profiles for each jurisdiction in which you do business. And for even more peace of mind, the aACE+ Avalara AvaTax integration uses geolocation to provide precise, up-to-date tax rates every time you make a sale.

To learn more about how aACE makes sales tax management easy, let’s look at how our sample company, aACME Education Solutions, uses these features in their day-to-day operations.

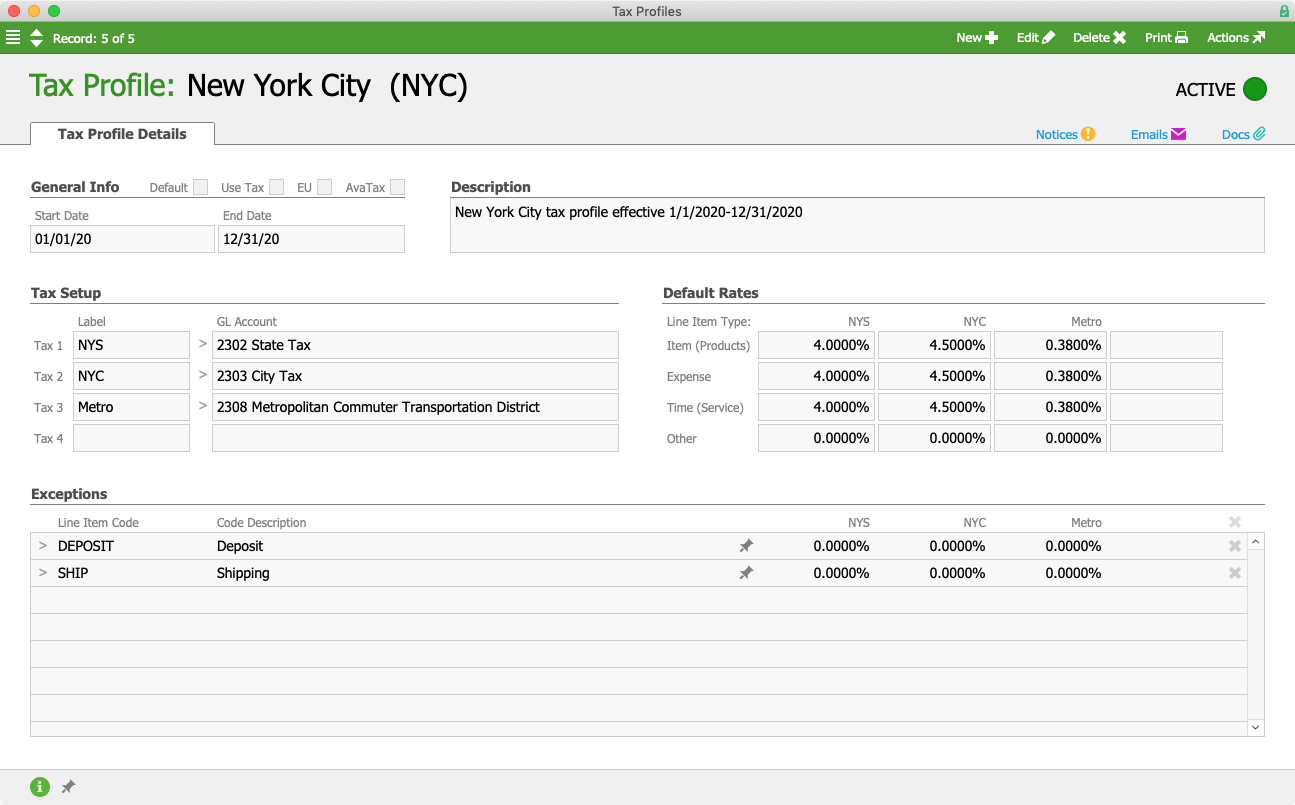

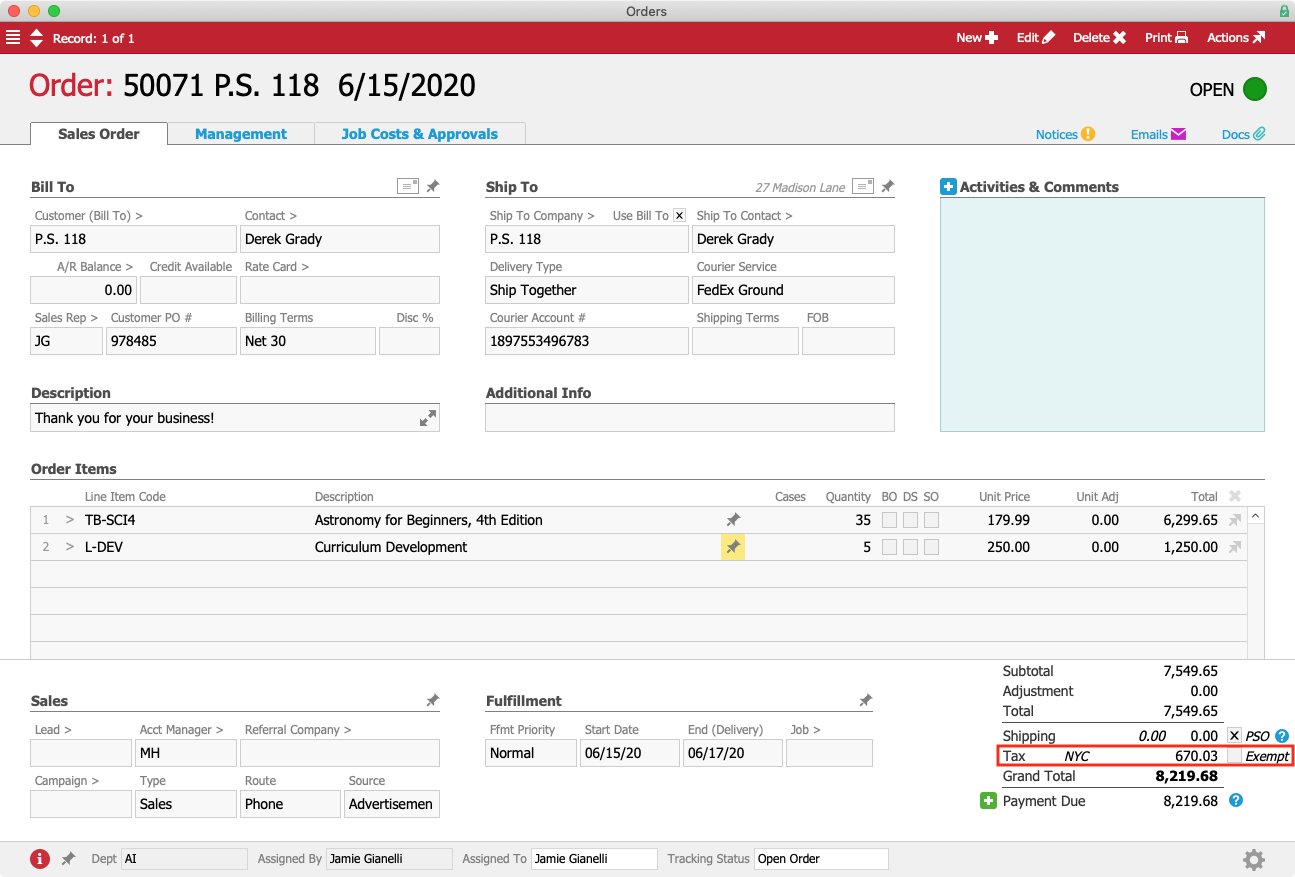

aACME sales rep Jamie Gianelli receives an order from P.S. 118 in the Bronx for 35 science textbooks and 5 hours of curriculum development. When Jamie creates the order, aACE automatically pulls in the NYC tax profile based on the postal code in P.S. 118’s shipping address. This tax profile is configured with each of the tax rates applicable in New York City as well as any items that are exempt from the local sales tax.

When Jamie processes the order, aACE calculates the sales tax and includes it in the grand total.

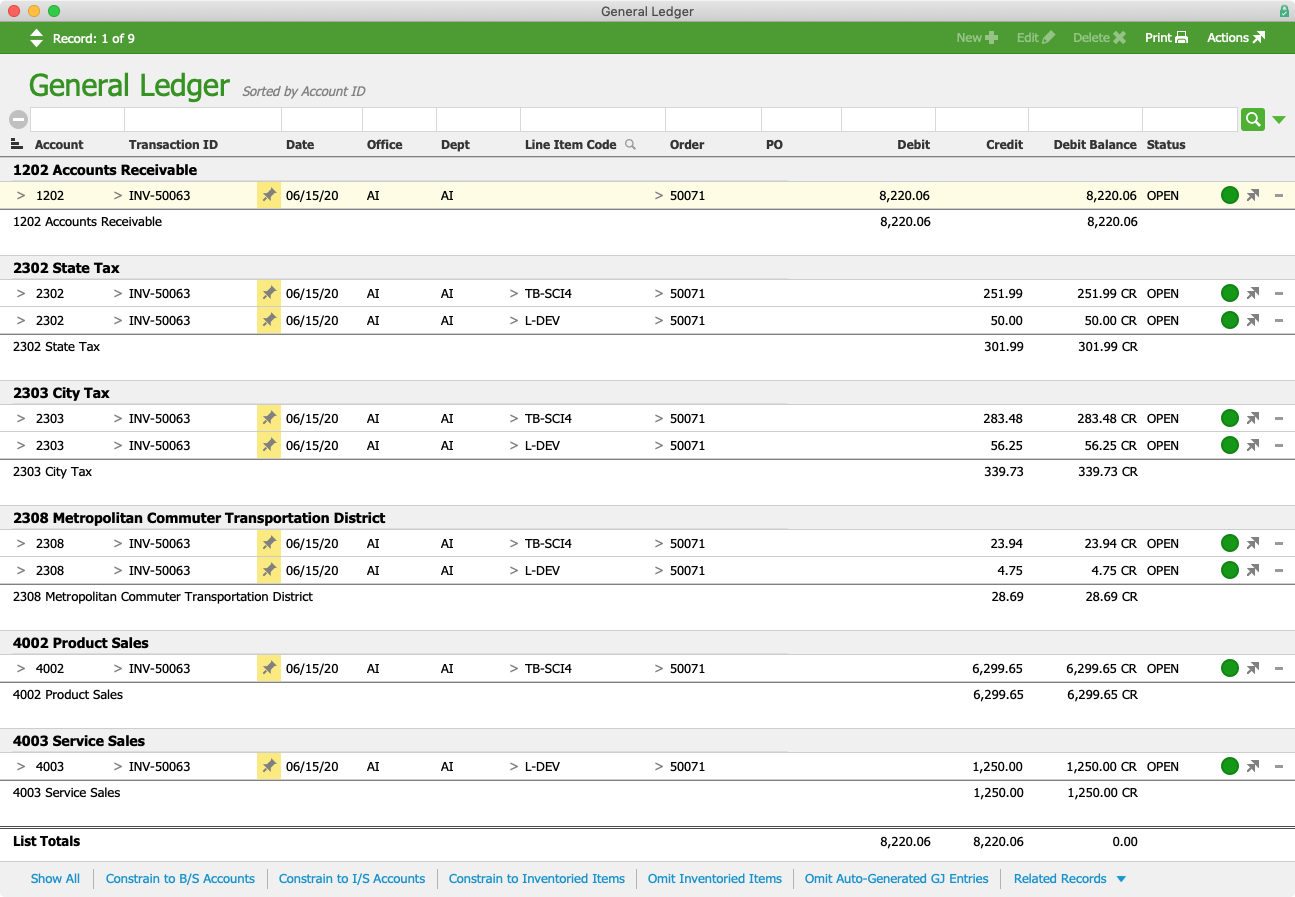

Once the order is shipped, Alexis Kohn in the Accounts Receivable department receives a notice that the related invoice has been generated. While inspecting the invoice to make sure everything looks accurate, Alexis wants to know how the sales tax was calculated. By navigating to the related general ledger transactions, she can see how much of the tax went to the GL accounts for the New York State, New York City, and Metropolitan Commuter District taxes, respectively.

This will become important when it comes time to remit these collected taxes to the government. Alexis will be able to easily see the balance owed to each tax agency and cut a check for those amounts.

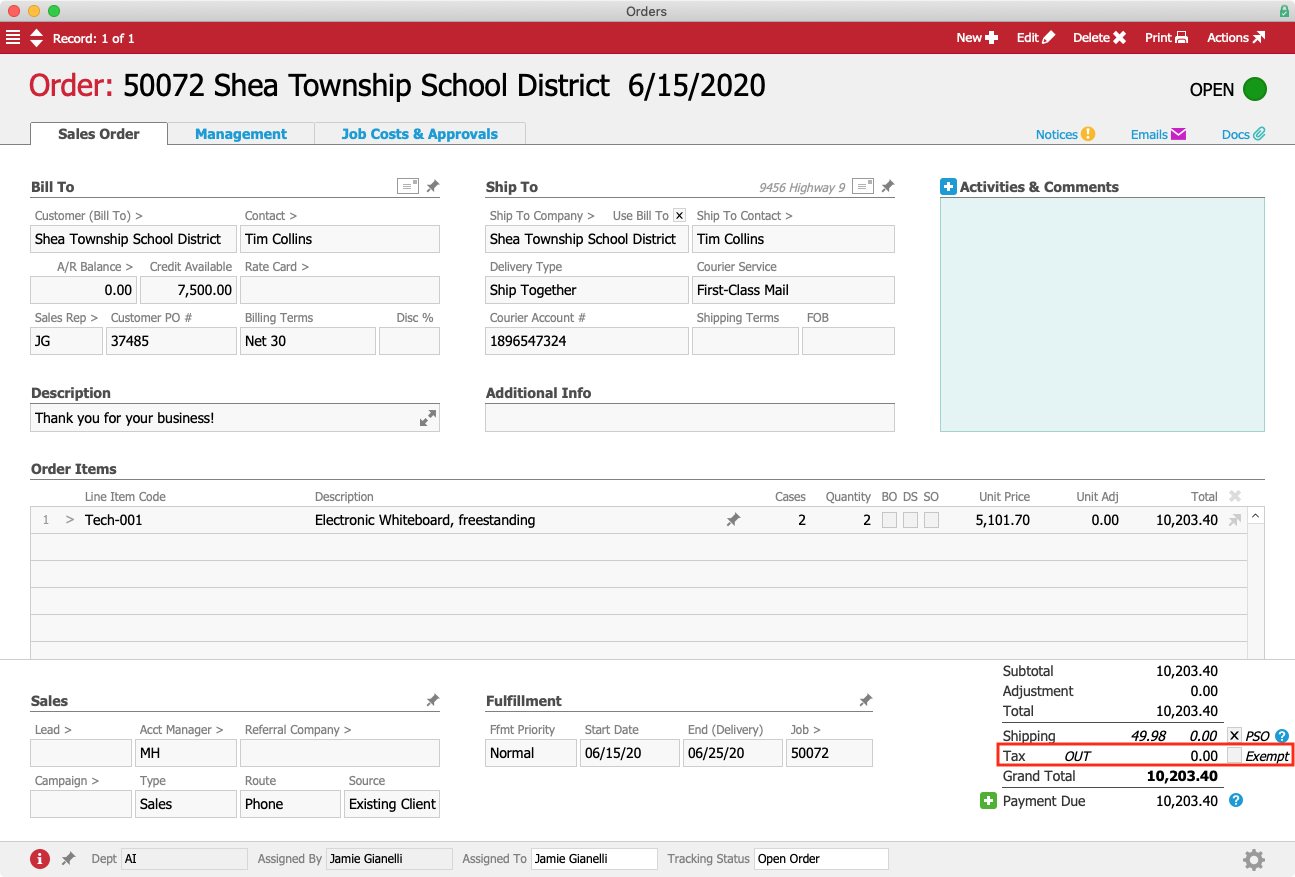

But what happens when an order comes in from a state where aACME is not required to collect sales taxes?

Jamie receives an order from the Shea Township School District for two new electronic whiteboards. Shea Township is located in Ohio, where aACME does not have a presence and is therefore not required to collect sales taxes. When Jamie enters the order, aACE automatically pulls in the Out-of-State tax profile based on the customer’s ship-to postal code. This tax profile is configured not to collect taxes, so when the order is processed, the sales tax comes to $0.

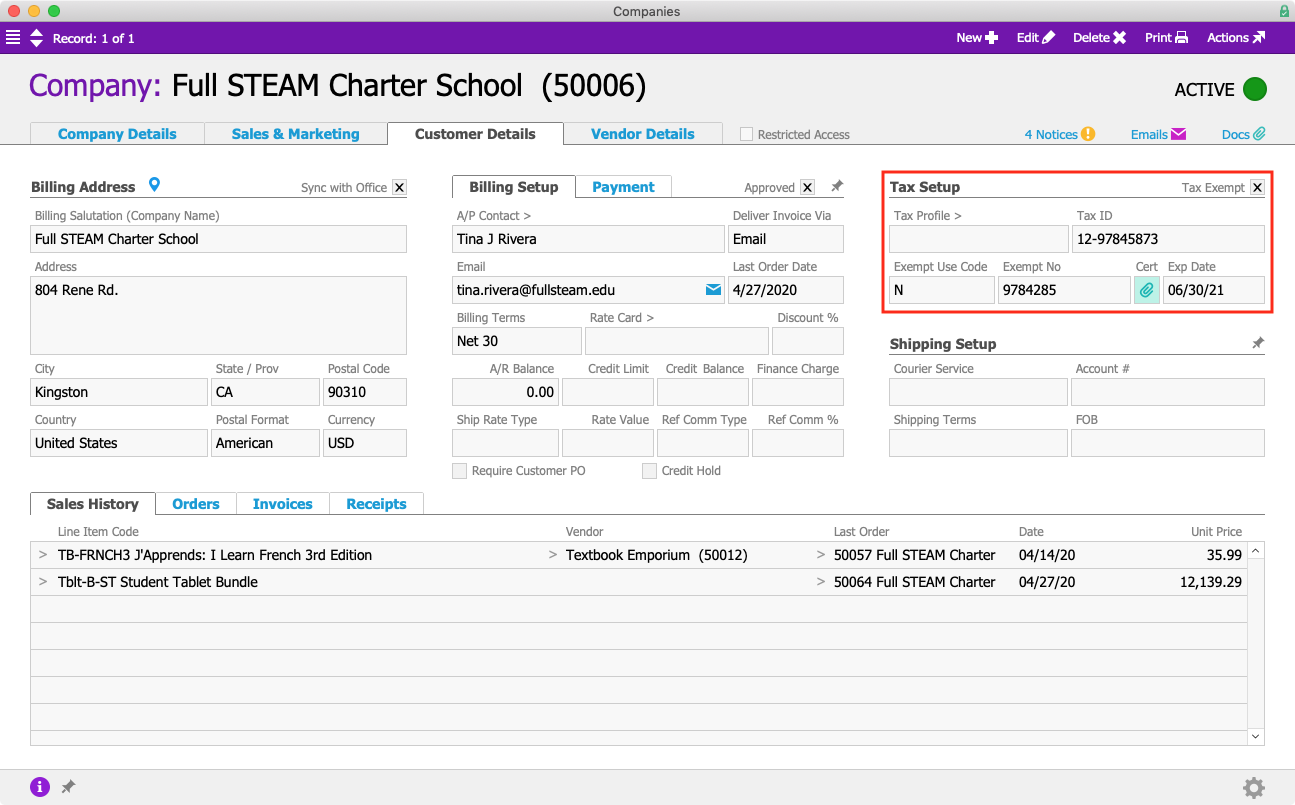

Similarly, aACE also includes tools for supporting tax-exempt customers. For example, longtime aACME client Full STEAM Charter School is a nonprofit and exempt from paying sales taxes. In Full STEAM’s Company record, they are flagged as tax exempt and their exemption certificate is kept on file.

Now you may be asking, what happens when a customer located in one tax jurisdiction places an order to be picked up in another jurisdiction? aACE can handle that, too.

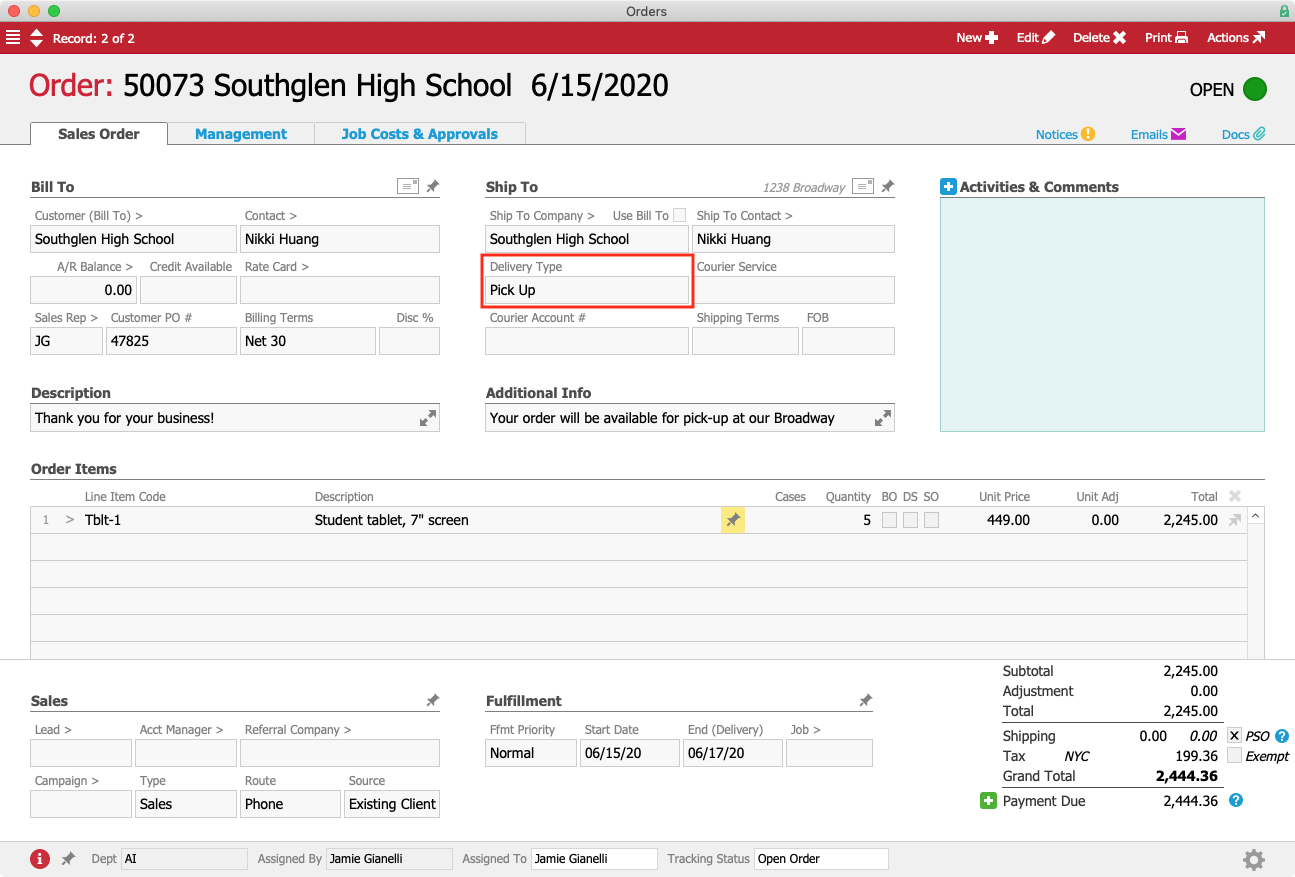

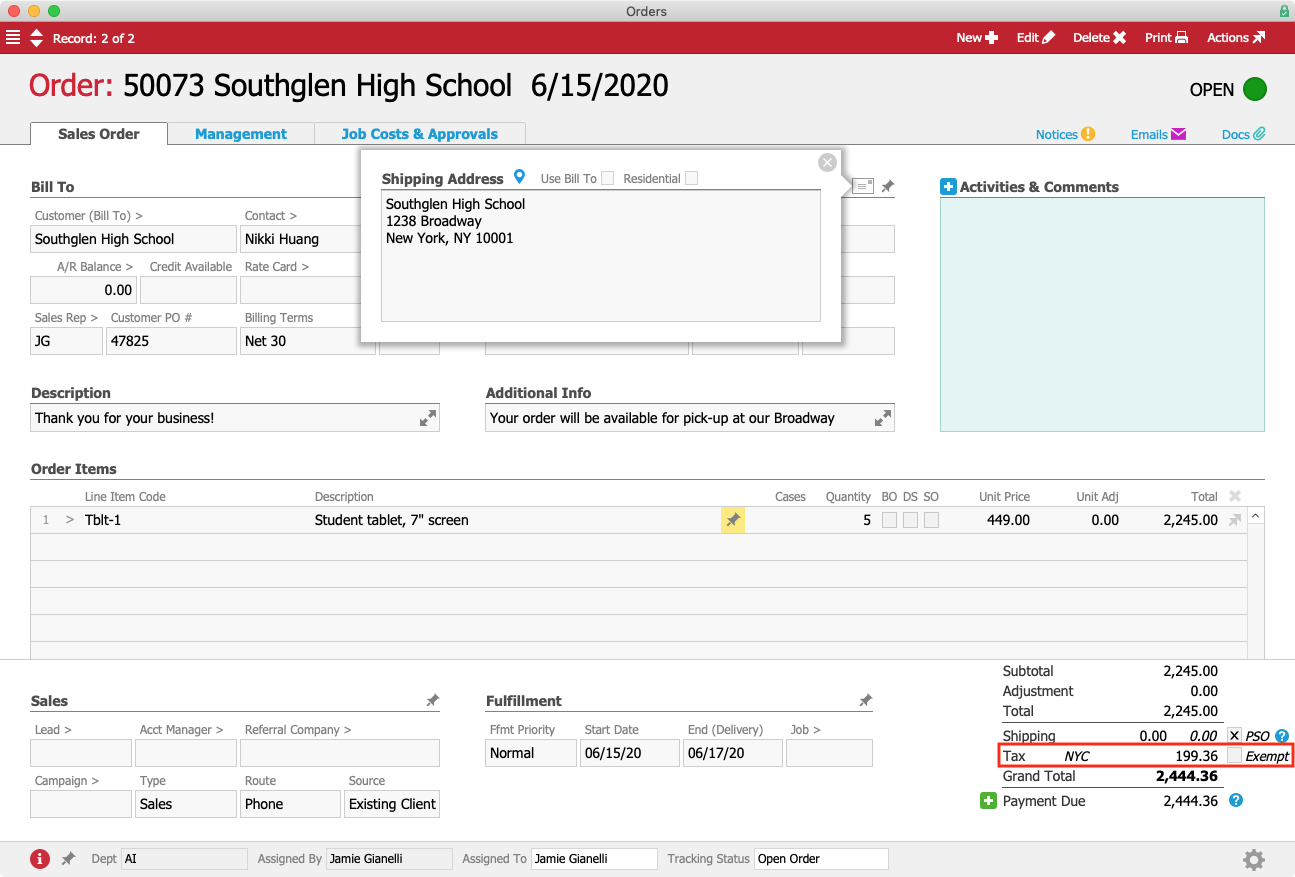

Jamie receives an order for 5 new student tablets from Nikki Huang at Southglen High School. SHS is located in Pemberton, NJ, but Nikki is going into the city for a conference and plans to pick up the tablets in person from aACME’s Manhattan location. When Jamie enters the order, she selects “Pick Up” as the type of delivery.

This automatically changes the shipping address from Southglen’s Pemberton campus to aACME’s New York office. aACE also pulls in the NYC tax profile based on the new postal code associated with the order.

As you can see, aACE’s out-of-the-box tax functionality makes it simple to collect and remit sales taxes. But if you have a presence in a large number of tax jurisdictions, you may not want to manually update dozens of profiles every time there’s a change in tax rates — and some tax jurisdictions don’t align perfectly with local zip codes, complicating matters even further. Then there are jurisdictions that tax certain items on a tiered basis — meaning the first $5,000 in sales, for example, is taxed at one rate while the next $5,000 is taxed at a different rate and so on — not to mention jurisdictions that tax items differently depending on the circumstances, like a raw chicken from the grocery store’s meat department vs. that same chicken sold after having been roasted at the deli counter. Wouldn’t it be great if you could automate sales tax collection with even more precision?

That’s where aACE+ Avalara AvaTax comes in.

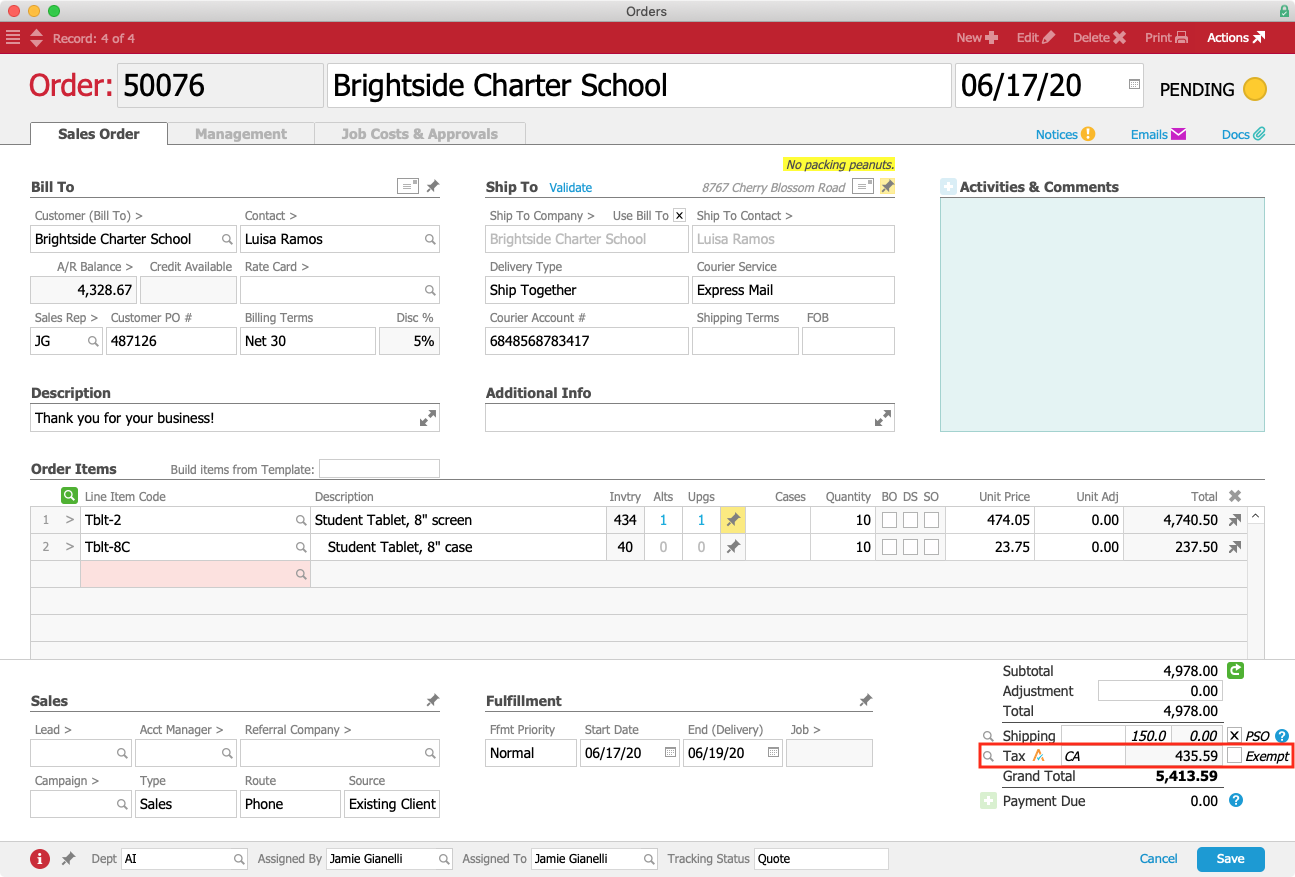

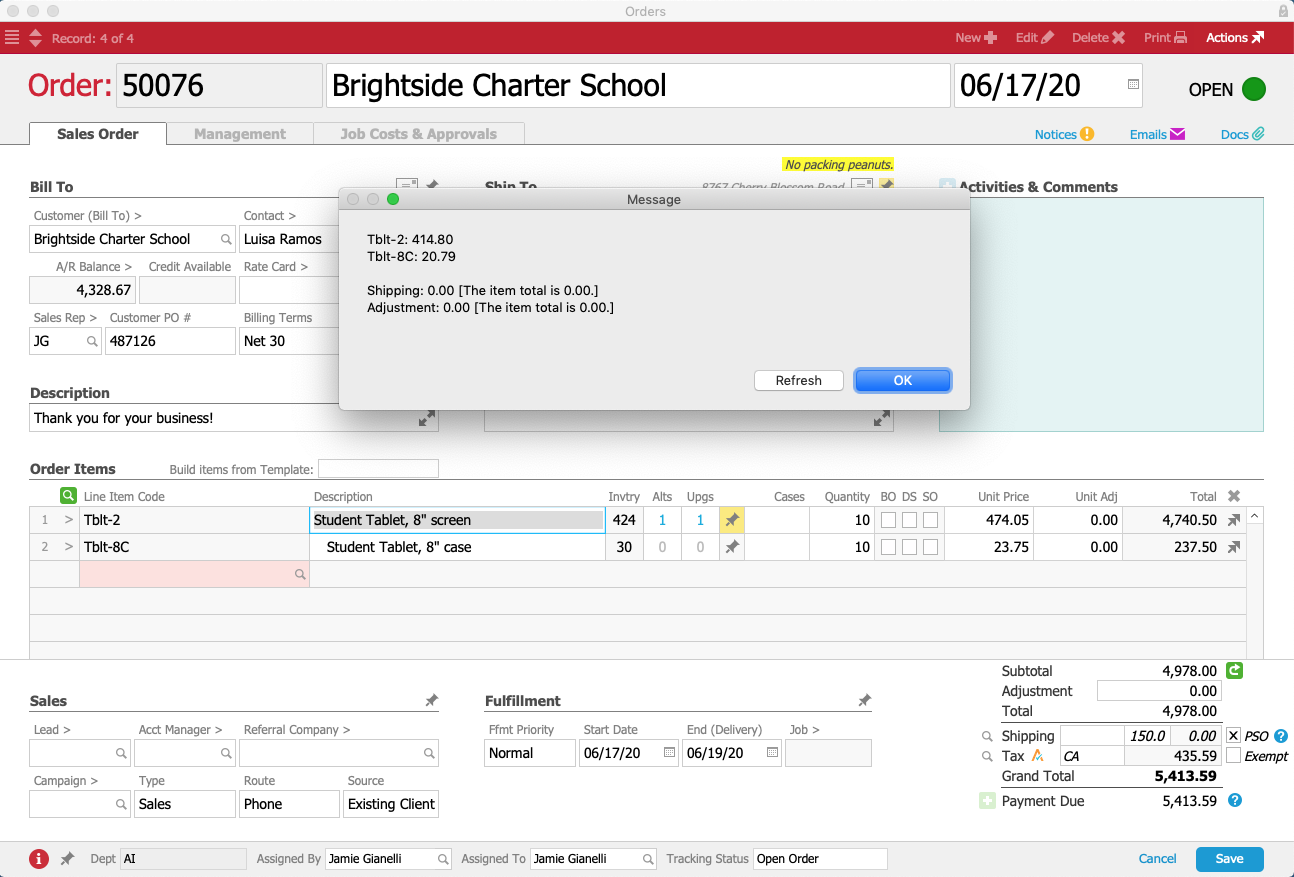

Jamie receives an order from the Brightside Charter School for 10 new student tablets and 10 cases — but now, aACME has implemented the aACE+ AvaTax integration. Like the previous examples, aACE auto-selects the tax profile associated with Brightside’s postal code. This time, however, the tax profile has AvaTax enabled as shown by the ![]() icon, which tells aACE to bypass its internal tax infrastructure and use the Avalara integration instead.

icon, which tells aACE to bypass its internal tax infrastructure and use the Avalara integration instead.

AvaTax calculates the order’s sales tax in seconds using the precise location of Brightside’s shipping address. Without leaving aACE, Jamie can see top-level details from AvaTax such as the amount of the order, the total taxable amount minus any discounts or exemptions, and the total sales tax.

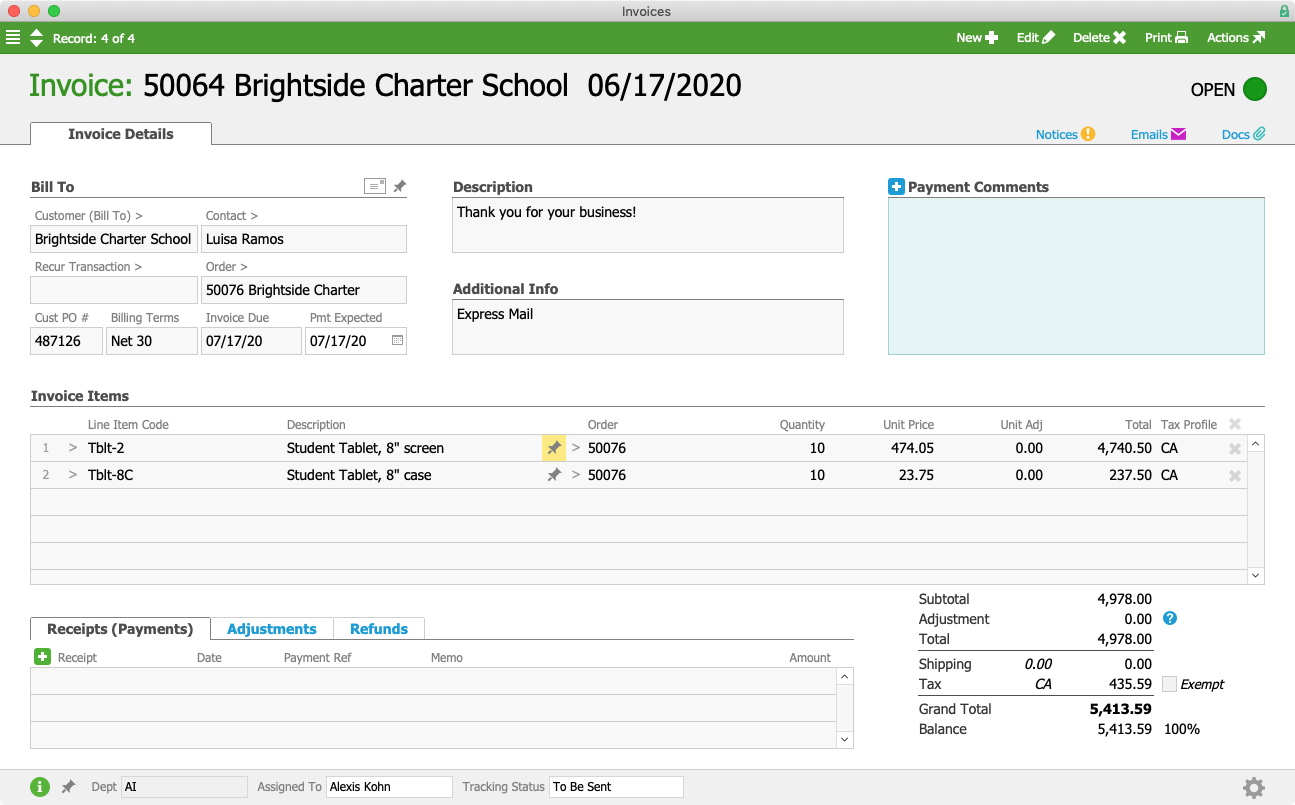

Once the order has been shipped, aACE again automatically generates an invoice. Over in the A/R department, Alexis logs in and reviews the invoice to make sure it’s correct before sending it to the customer.

If Alexis ever needs to double-check the tax calculations for this invoice, she can simply log into aACME’s Avalara AvaTax account. She finds invoice #50064 in the Transactions portal and opens up the detail view. Alexis can see the sales tax for the invoice broken down by line item, including the taxable amount of each line item, any discounts, the taxes or fees associated with each item, and the cost of each item with taxes included.

For more details, Alexis can click on the line item for the tablets. Here she can see each individual tax jurisdiction that this item was subject to as well as the tax rates and total tax amount for each one. When tax time rolls around, Alexis will use Avalara’s robust reporting and filing tools to remit any accrued taxes to the appropriate jurisdictions all over the country.

aACE tax profiles and the aACE+ Avalara AvaTax integration can help take the headache out of tax time. To learn more about aACE+ AvaTax, check out our landing page on Avalara’s website. And to discover how aACE can help streamline your business’s operations, register for a webinar today.