7 Ways to Increase Customer Engagement for Big Gains in eCommerce

In light of COVID-19 social-distancing and stay-at-home orders — which have now spanned three months or longer in some areas — many businesses are struggling.

Some, particularly those in retail, that closed doors temporarily have announced they will likely never re-open. Others, like restaurants, have adjusted from full indoor tables to take-out orders, curbside pick-up, and limited outdoor seating.

Other industries are doing better — and in some cases even thriving, especially those engaging in ecommerce.

In late April, for example, ecommerce in the United States was up more than 120% compared to the same time last year. The latest numbers show great promise with late May remaining at more than 110% over the previous year.

This may not be a trend that’s likely to disappear when communities go “back to normal” post-COVID-19. One report indicates that by 2040, some 95% of purchases may be made through ecommerce. By next year, there will likely be about 2.14 billion digital buyers around the world.

If you’re a retailer of goods and services and you’re not already actively engaged in ecommerce — or you’re not doing so strategically — you could be falling behind while your competitors make gains.

First, what is customer engagement?

Customer engagement, while broad, encompasses all the ways your brand and customers (including potential customers and former customers) interact with one another. These interactions can represent a range of communications. The more successful companies offer customers a multitude of engagement opportunities and then let the consumer decide which option works best. While not exclusive, here are some examples of customer engagement channels:

- Calls

- Text messages

- Emails

- Chats, both with bots and real people

- Reviews and ratings (both positive and negative)

- Feedback/website forms

- Social media comments

- Likes and follows on social media

- Direct communication with your employees and staff

- Customer support portals

Why is customer engagement important?

Customer engagement is more than selling products and services, but, if done well, that will be the end result.

Customer engagement is about setting yourself apart from your competitors and building trust — and often an emotional connection — between your customers and your brand. The better your customer experiences are, the more likely you may be to convert sales leads into customers and retain them for additional, ongoing purchases with your company.

Not sure what’s effective or where to begin? Here are 7 ways to increase customer engagement for big gains in ecommerce:

1. If you don’t have an ecommerce site, now is the time

According to the 2020 Remote Payments Survey from PYMTNS.com, in 2020, consumers are more than 30% more likely to make an online purchase than they were the previous years. It’s a move fueled by COVID-19 forcing closures of many brick-and-mortar stores, but with convenience, speed, and reliability increasing with online retailers, it’s a trend that may not dissipate in the near future.

If you don’t have an ecommerce site to help you deliver goods and services to the public — and especially if your retail locations have been closed or have limited capacity — you’re missing an opportunity to engage with your customers who may very well be stuck at home or limiting their in-person interactions to only essential services.

The United States, according to Statista, has one of the highest ecommerce penetration rates of anywhere in the world. Pre-COVID19, the report indicated that in 2019, some 80% of internet users in the U.S. were expected to make at least one purchase online, which is up from 73% from 2013.

2. Focus on the ecommerce experience

Today, it’s not just enough to have an ecommerce site (although it’s a great place to start!). You also need to ensure that your site works properly, is engaging, and easy to use.

Here are some questions to consider when auditing your ecommerce site:

- Is your site visually appealing?

- Does it load quickly with no technical issues?

- Is your site secure?

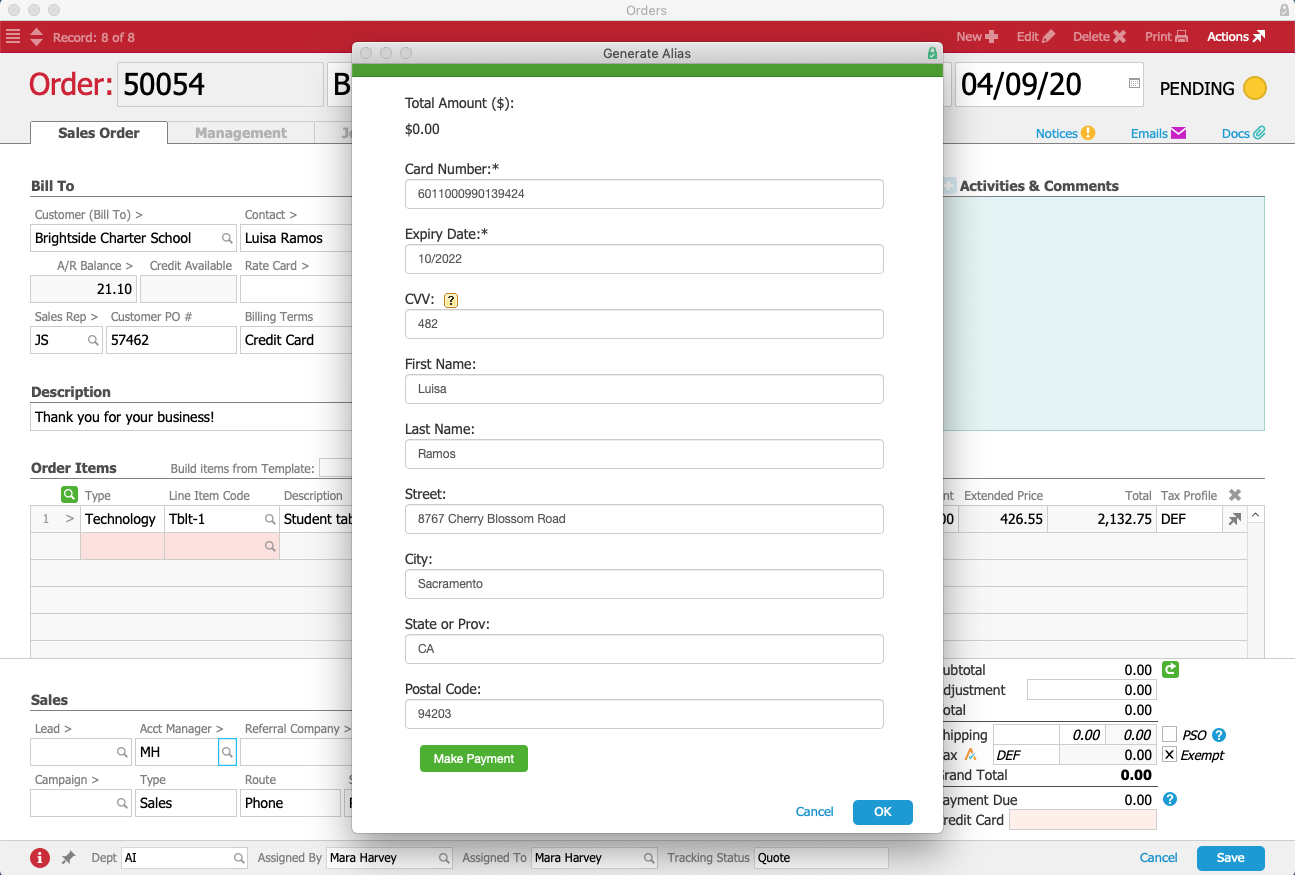

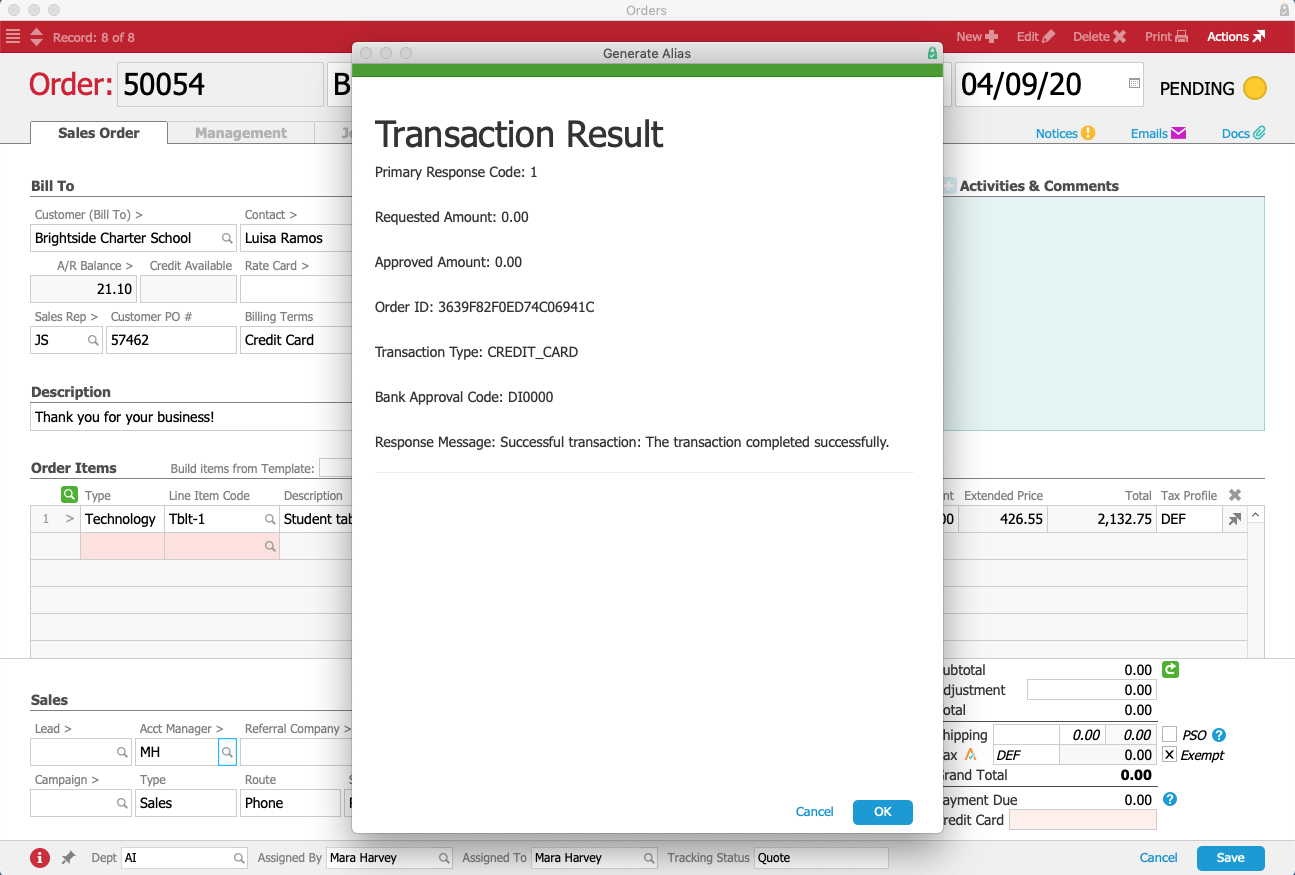

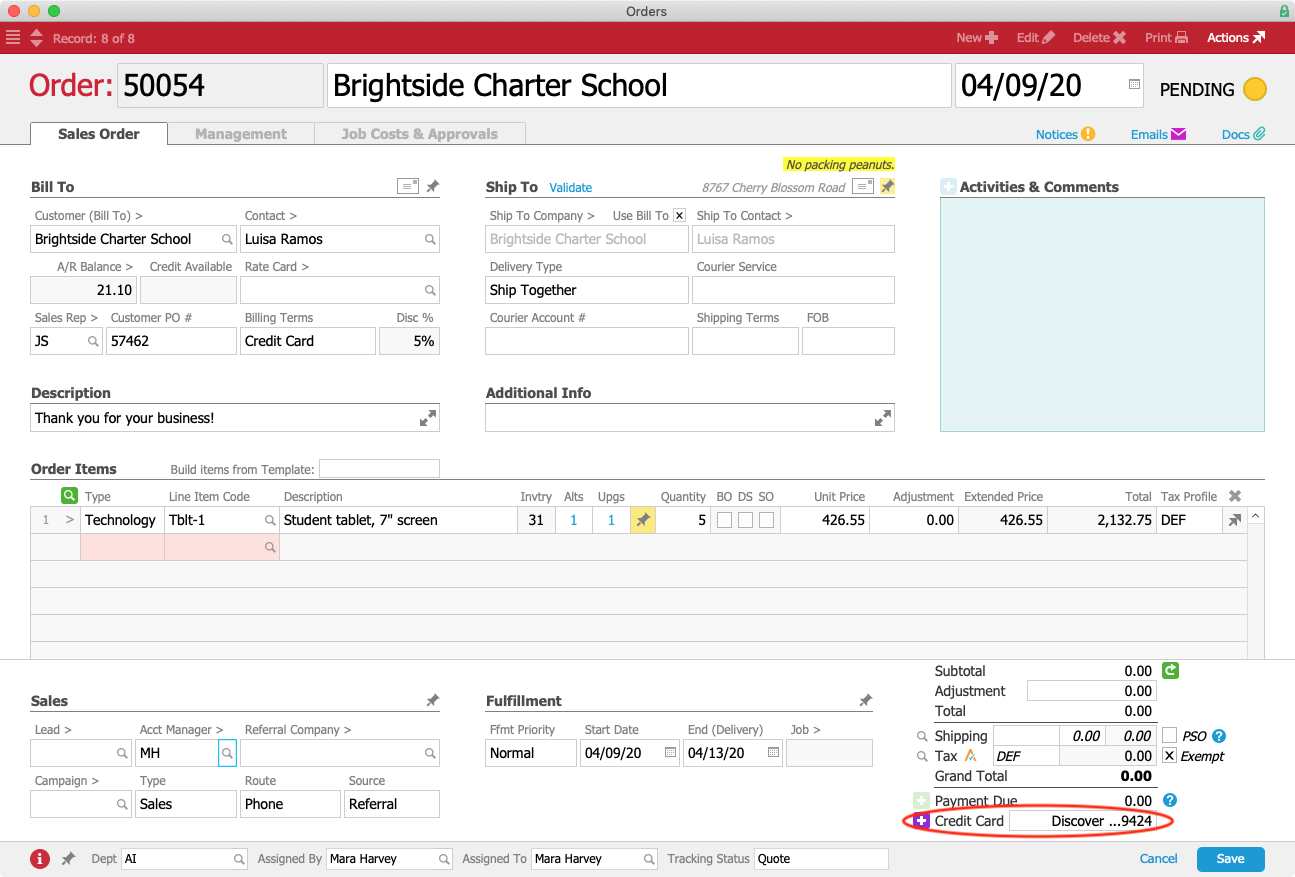

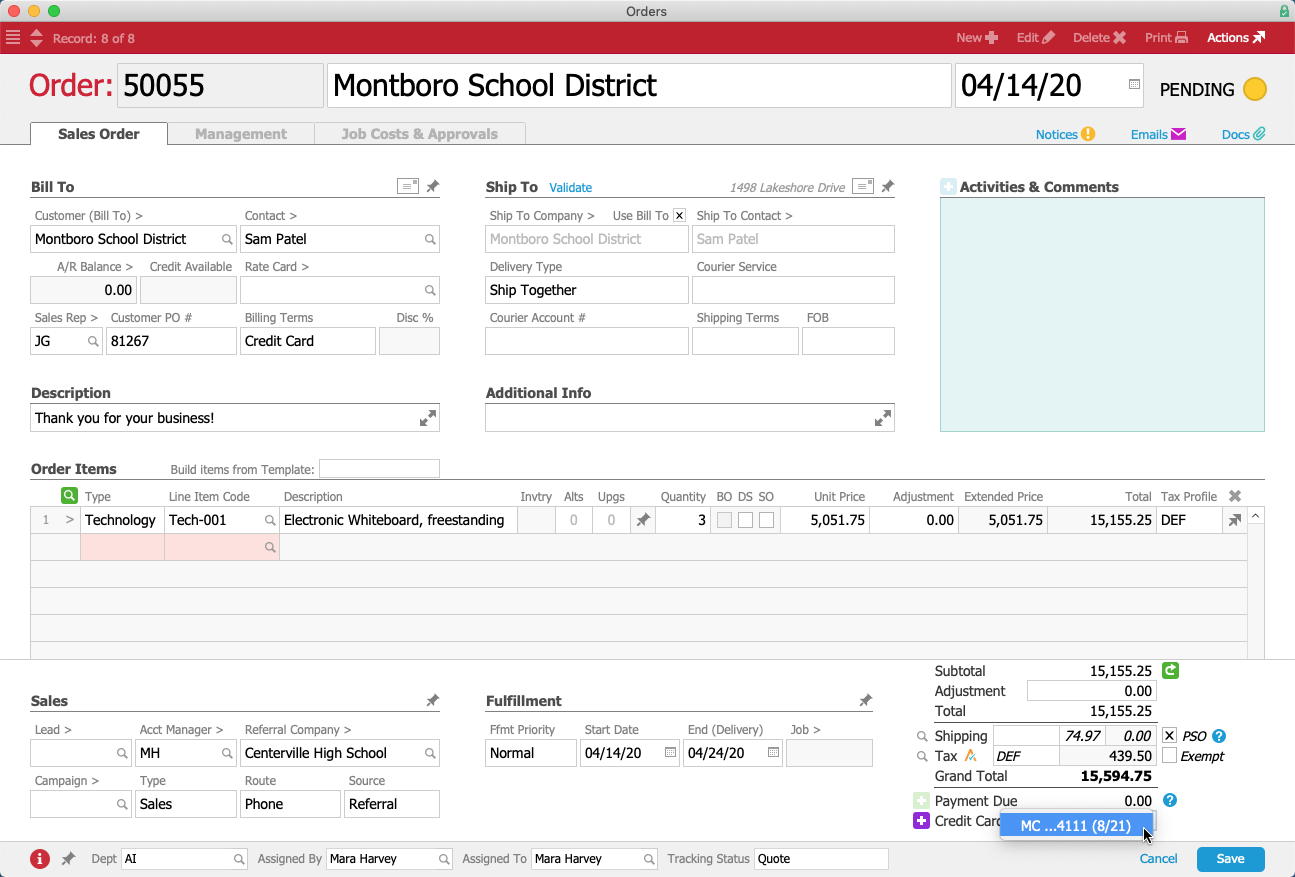

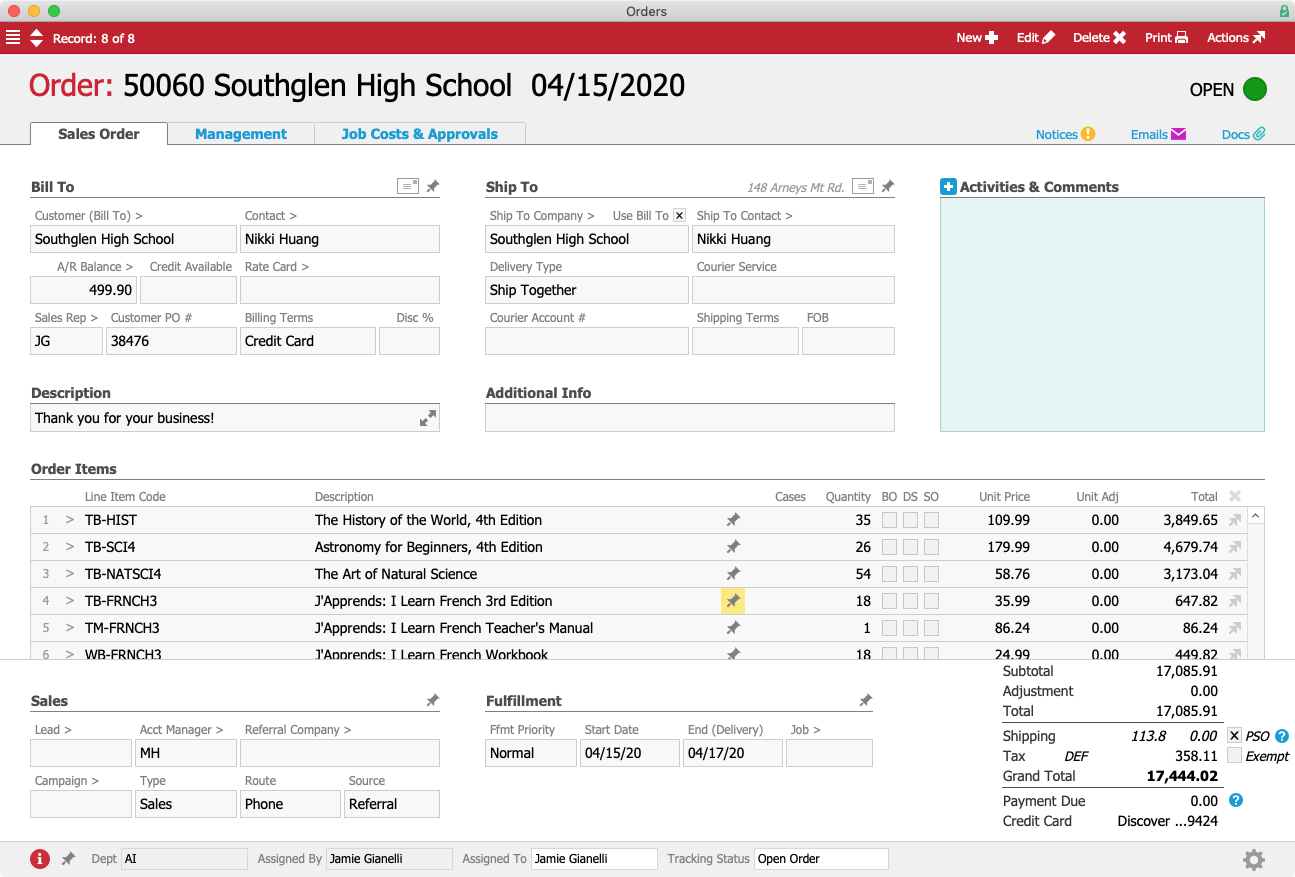

- Does your site accept common, trusted payment methods such as credit or debit cards or PayPal?

- Does your site effectively tell your brand story and connect with consumers?

- Does your site make it easy for users to find what they’re looking for?

- Is pricing clear and easy to understand?

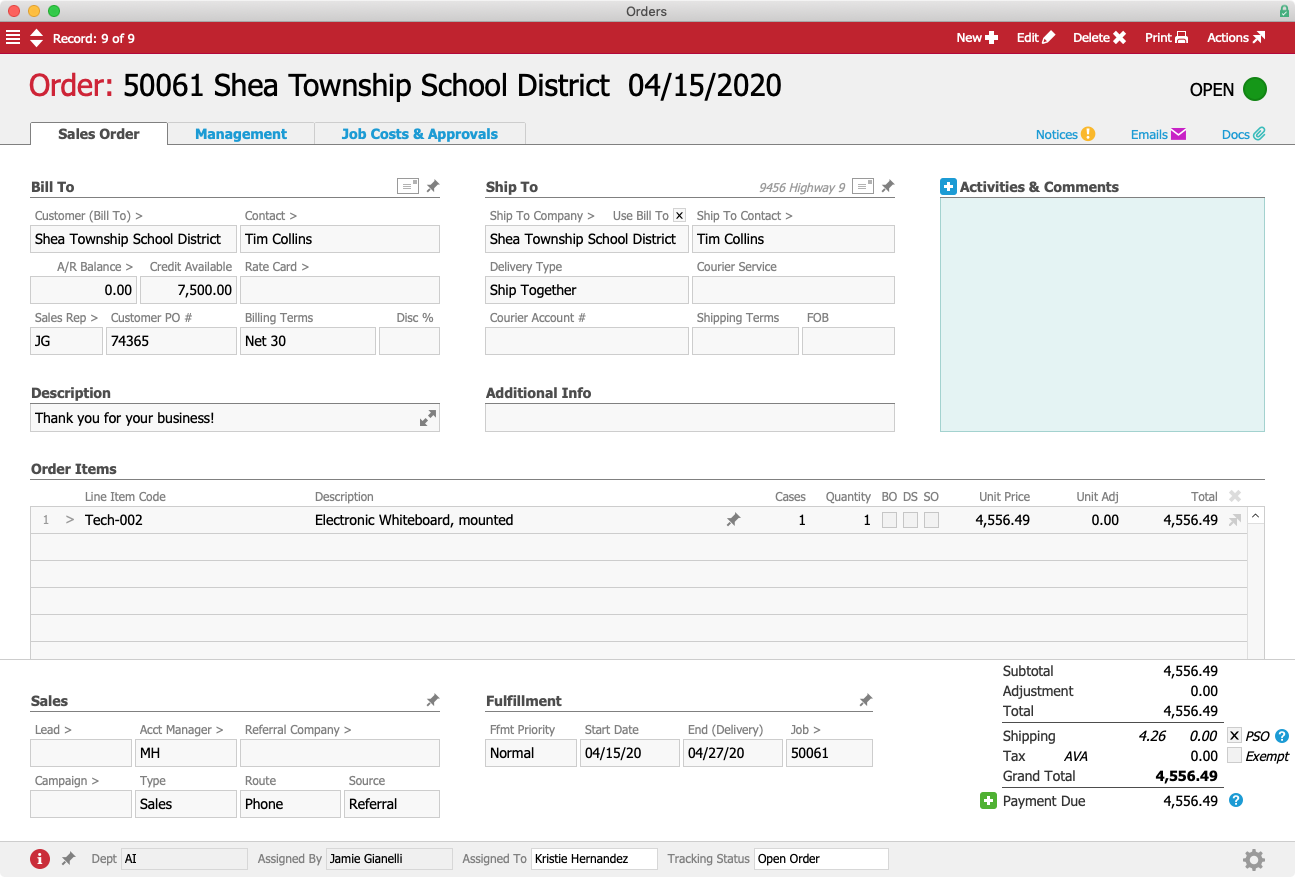

- Do you offer a variety of shipping alternatives?

- Do you make it easy for your customers to communicate with you if they have questions or concerns?

- Is your site mobile friendly?

While you may be stuck at home working from a laptop or computer during coronavirus restrictions, remember, a growing number of your potential customers are likely using mobile devices to connect with you. At least 72% of respondents in that PYMNTS.com payment study are using mobile devices for ecommerce.

And because the adoption of mobile devices and high-speed internet have made most consumers accustomed to fast service, it’s important to ensure your site loads quickly on both desktop and mobile devices. That’s because on average, almost half of consumers expect a site to load in two seconds or less and about 40% of your potential customers will leave your site if it takes longer than three seconds to load.

3. Focus first on re-engaging existing customers, then attracting new ones

Acquiring new leads and converting them to customers is challenging, time consuming, and it can be expensive.

In tough times, your efforts may be better focused on re-engaging existing customers than trying to find and convert new ones. That’s because in most cases businesses have a 60-70% chance of selling something to an existing customer. For new customers? That chance can drop to as low as 5%, and in best cases, only 20%.

This can be especially beneficial if you’re trying to sell a new product or service because your existing customers can be seven times more likely to try it. And the good news doesn’t stop there. Those repeat customers are more likely to spend more money with you — almost 70% more than a new customer.

Not only do these customers spend more with you, it’s cheaper to retain an existing customer than find and convert a new one, which can cost you six to seven times more.

And existing customers are almost 60% more likely to return to your site if you recommend more relevant products.

4. Get social

While people are stuck at home during this pandemic, more people are using social media more frequently. In an early study at the start of the outbreak, some 43% of users said they thought they would use social media more while at home. Think about it for yourself. How many times have you aimlessly scrolled social media during the past few months? This is a great place to focus your marketing efforts for your ecommerce sites.

If you have an advertising budget, target your social media ads to existing customers. But even without one, you can use social media as a tool to share your brand’s stories, offer promos and deals, and engage with your customer base.

5. Listen

eCommerce success will take more than just being on multiple social media and digital advertising platforms. You also need to listen to and engage with your customers. Meet them where they are.

Don’t just push messages and posts outward. Monitor all your accounts and engage with the customers who engage with you. Create compelling content that encourages engagement. Respond to messages quickly with integrity and offer viable solutions to known problems. Graciously accept criticism and say thank you to the customers who support you.

Did you know that 65% of U.S. consumers say that a positive brand experience is even more influential than advertising?

6. Capture data and deliver personalized experiences

When it comes to ecommerce, personalization is key. Hopefully, you’ve already tailored your marketing messages to your core buying demographic, but today, modern buyers expect much more.

About 45% of online shoppers say they’re more likely to shop on a site that offers personalized recommendations and the click through rates for digital advertising is more than 10x compared to ads without personalization.

7. Have great customer service

Earlier in this post we mentioned some of the communication channels you could use to engage with your customers. These days, ecommerce isn’t just about setting up a site and waiting for customers to come to you. You have to go to where your customers are and engage with them. That engagement includes exceptional customer service with fast and effective responses.

And the better your customer service, the stronger your ecommerce sales may be. One Gartner report indicates that almost 90% of companies expect to compete for customers based primarily on customer experience.

Quality customer service is key here. Not only do 73% of customers say their customer experience is an important factor in purchasing decisions, but some 42% are willing to pay more for a product if they have a welcoming customer experience.

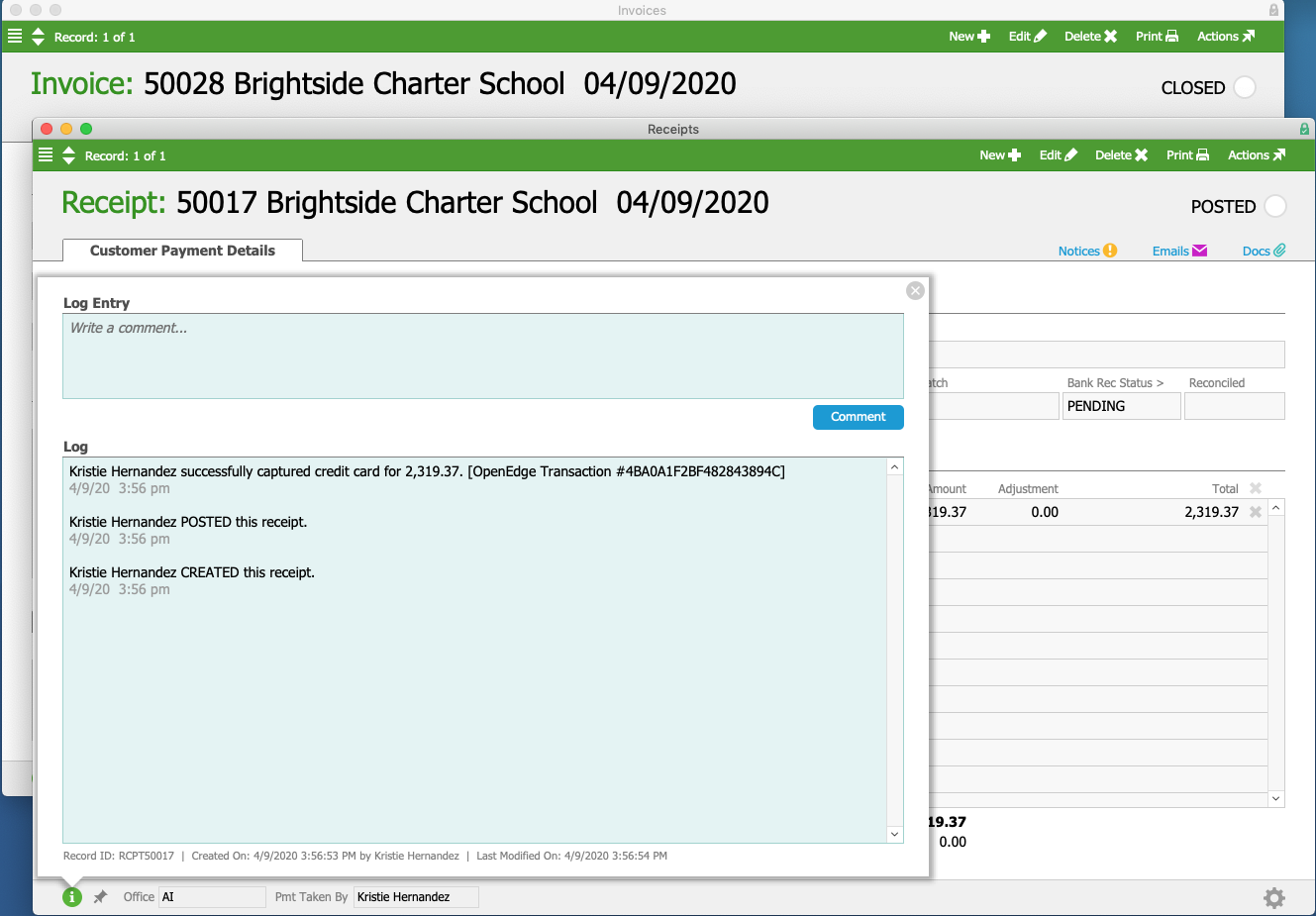

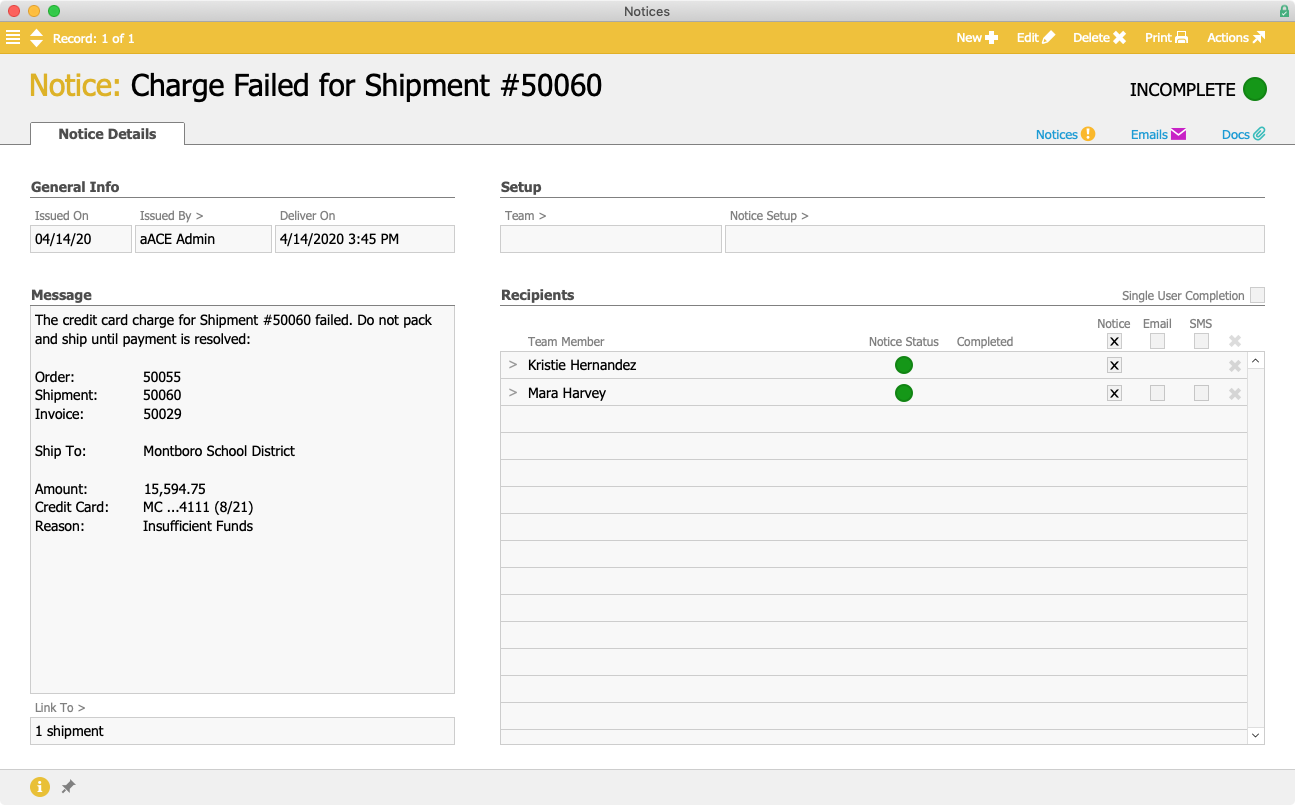

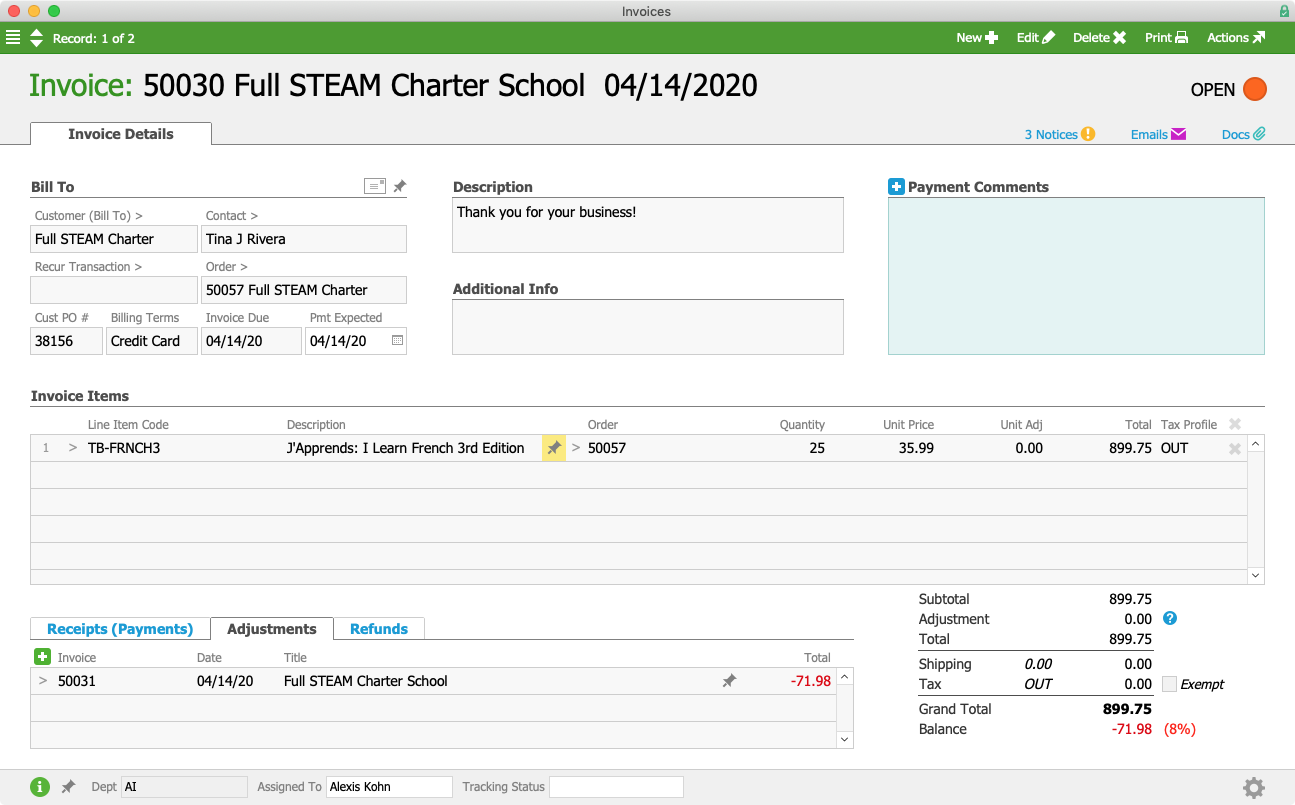

Facilitate engagements with business management software

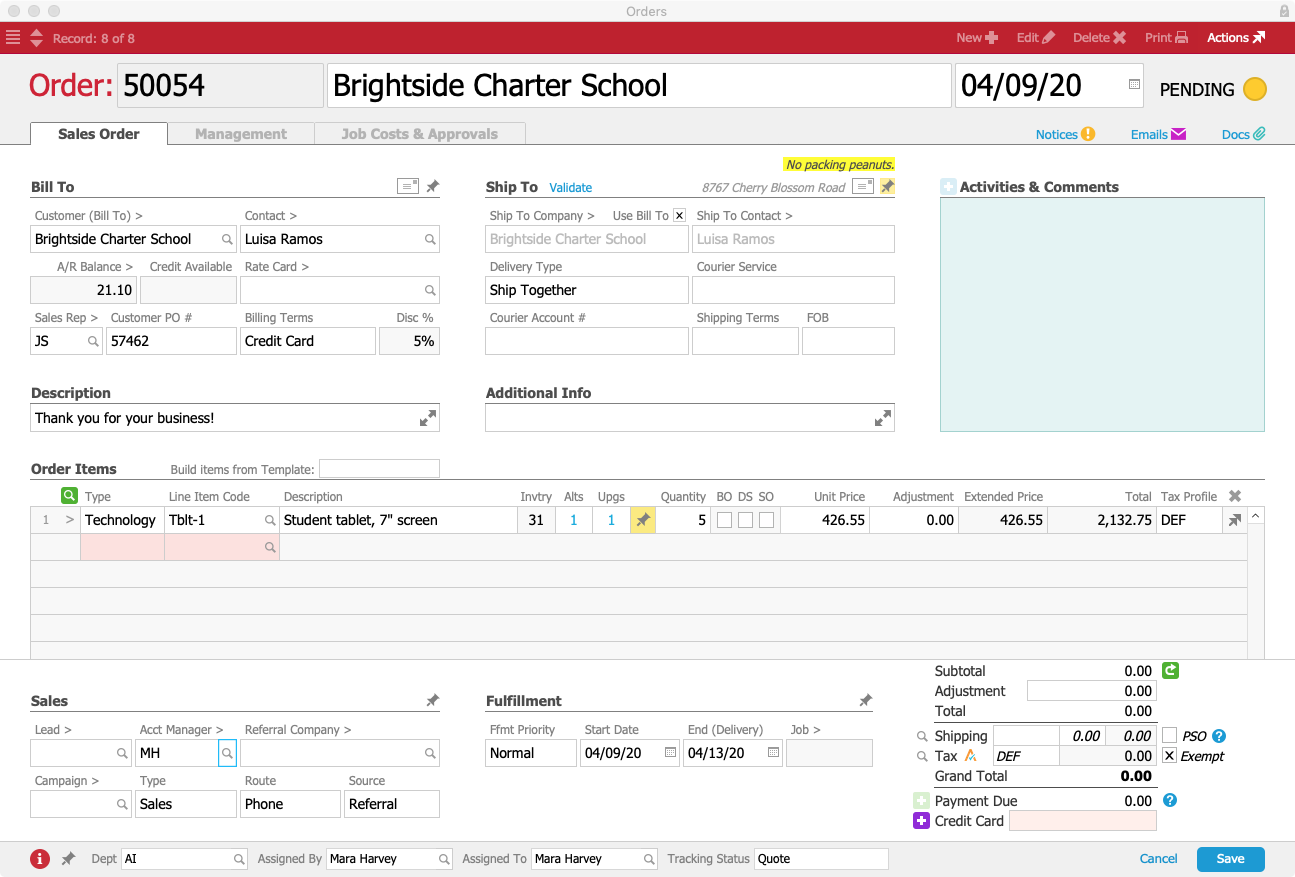

There are a lot of moving pieces and parts to an effective customer engagement strategy. It can be challenging to keep up with it all. Business management software (BMS) can help.

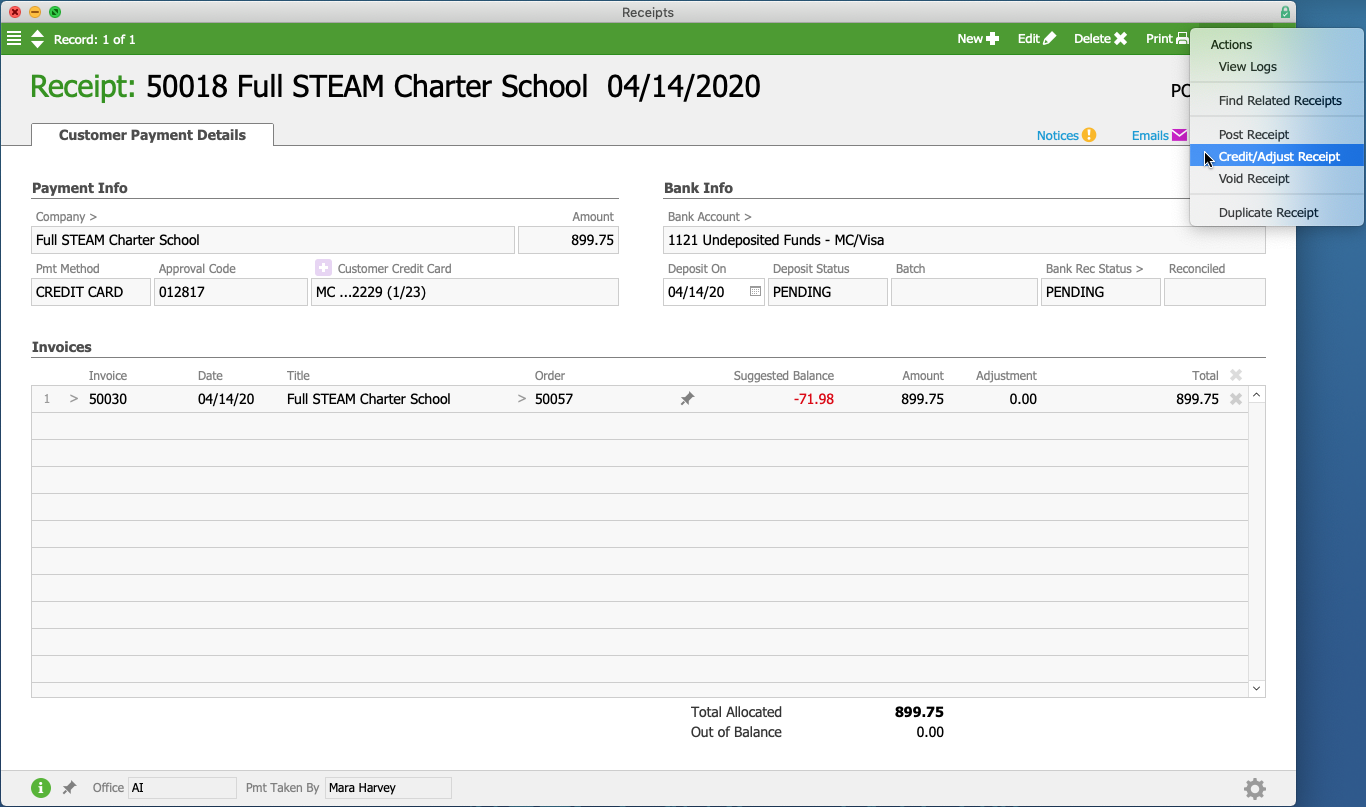

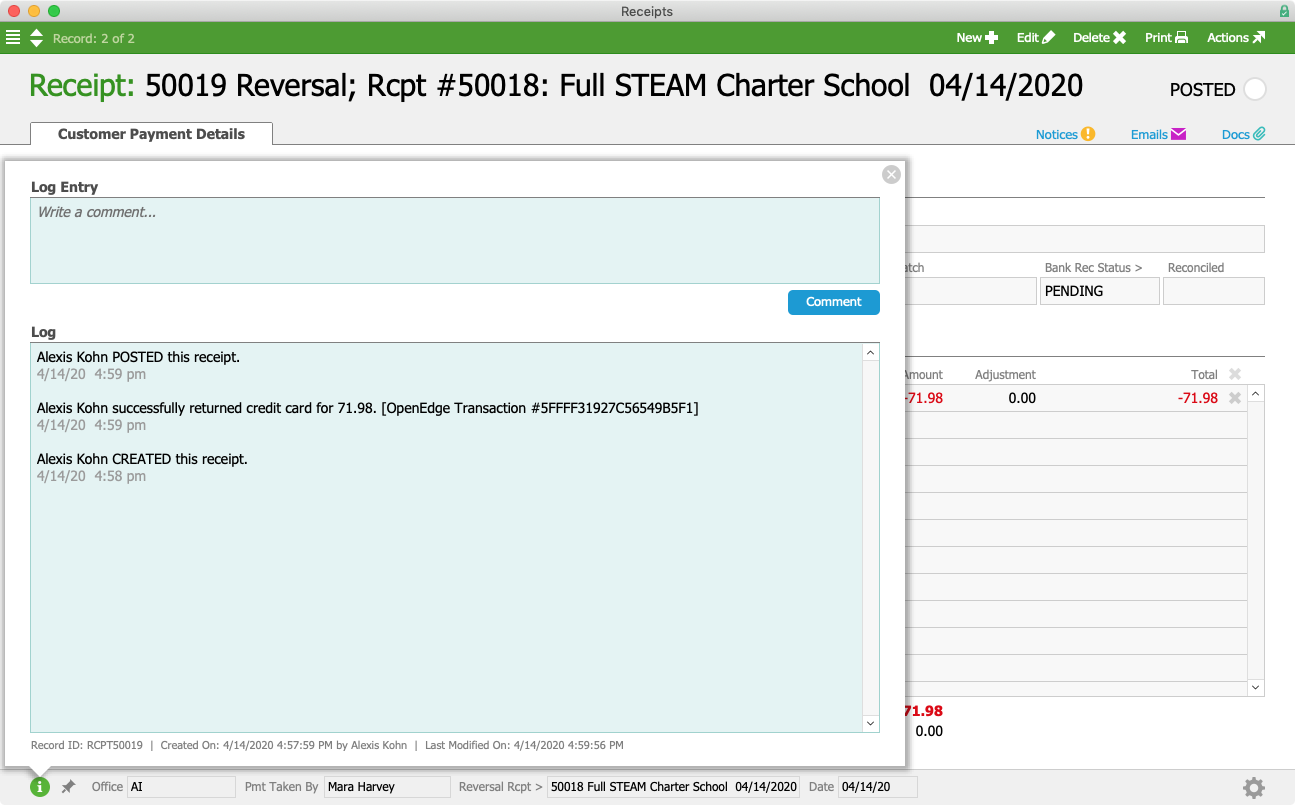

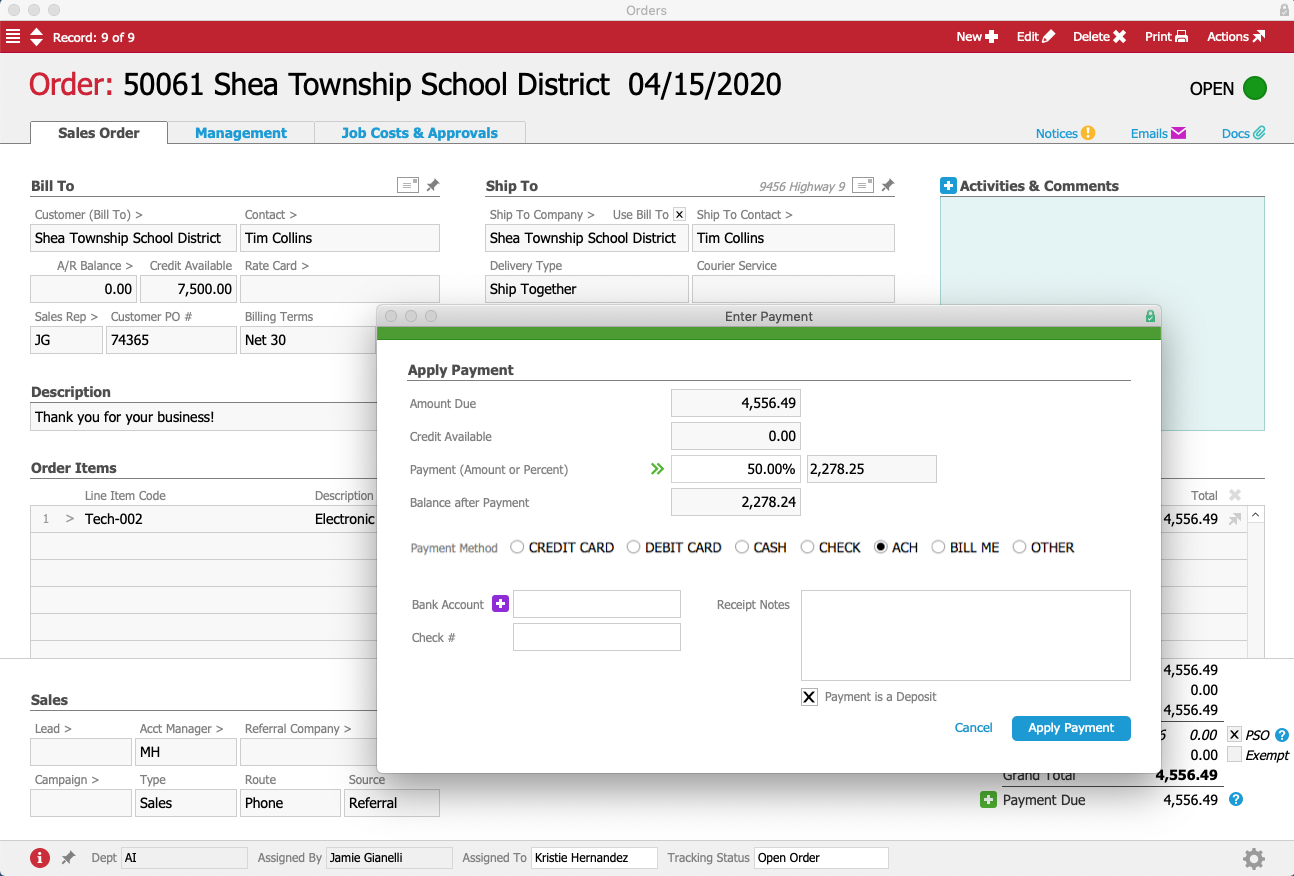

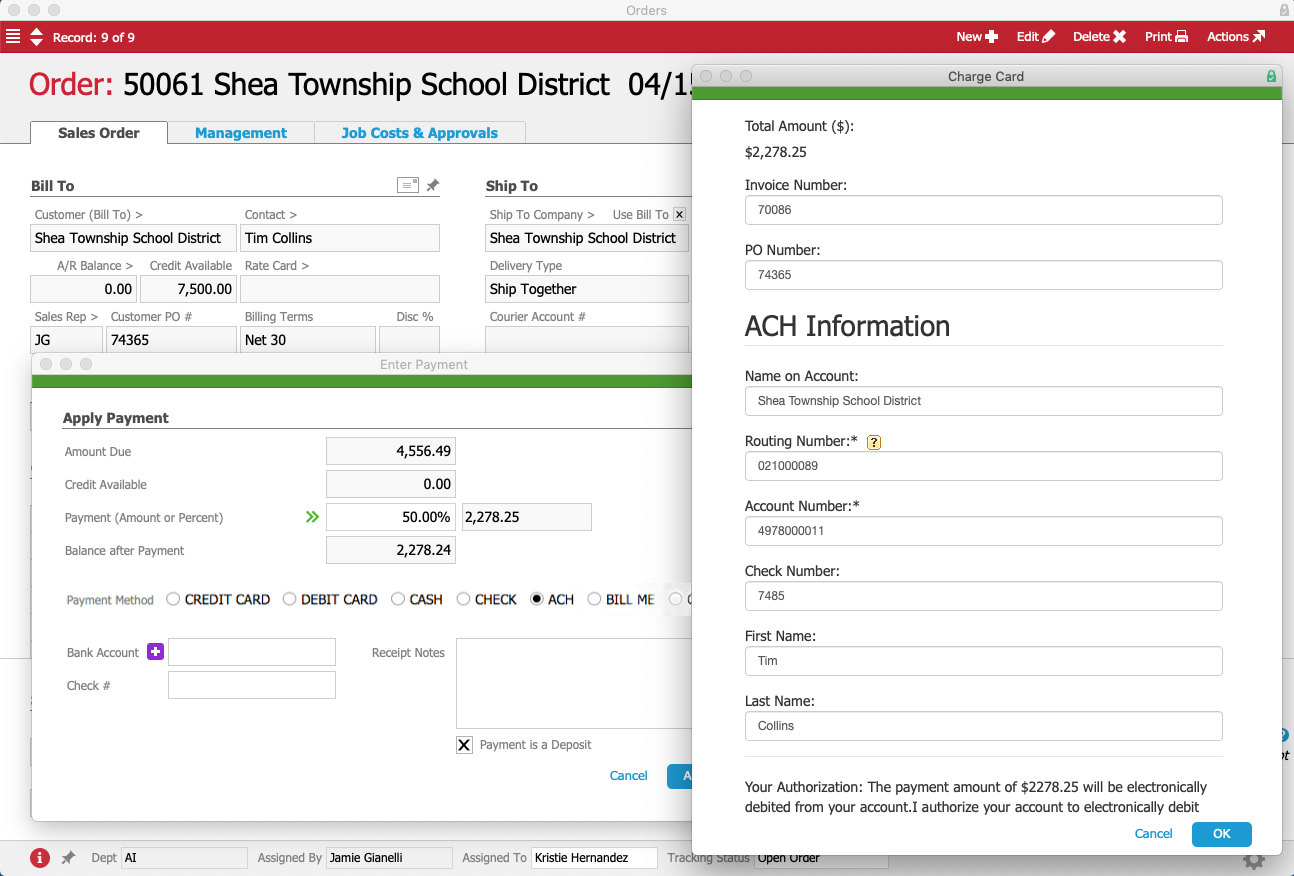

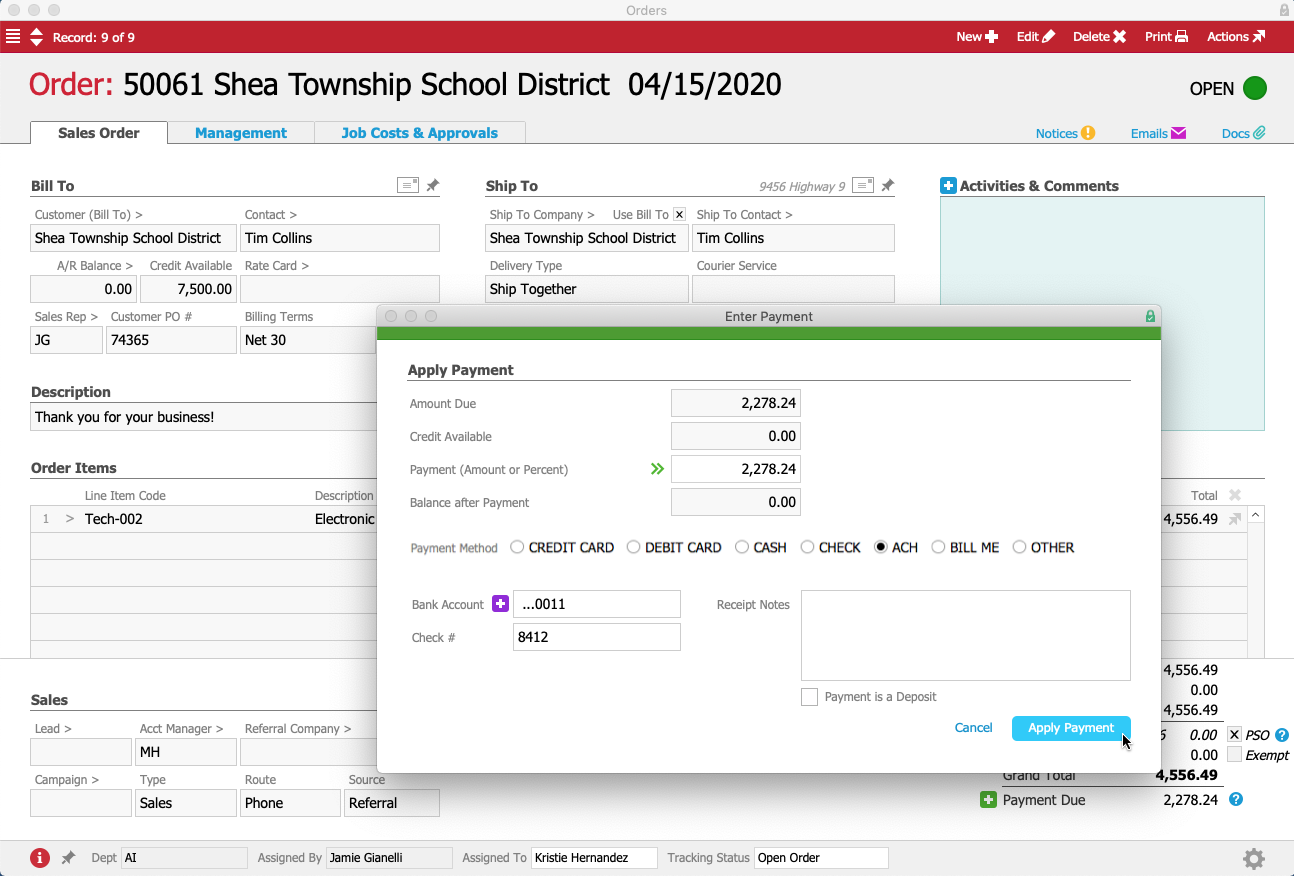

You may want to consider a BMS that easily integrates with your existing operational systems and applications. BMS can help you streamline processes for your customer relationship management software (CRM), your accounting system, billing, and even shipping and receiving.

If you’d like to learn more, join aACE for our “Sales Leads and aACE CRM App” webinar on June 16 where you can learn more about using a BMS to increase your customer engagement. Register now to reserve your spot!