Sales tax calculations can become messy when your business ships packages to multiple tax jurisdictions. Taxes are already complicated enough. Wouldn’t it be nice to have a solution that could simplify your sales tax calculation process?

aACE’s out-of-the-box tax management infrastructure allows you to manage taxes for each jurisdiction in which you do business. You can create a “tax profile” in aACE to store your jurisdiction information and easily link it to a postal code.

Interface Spotlight

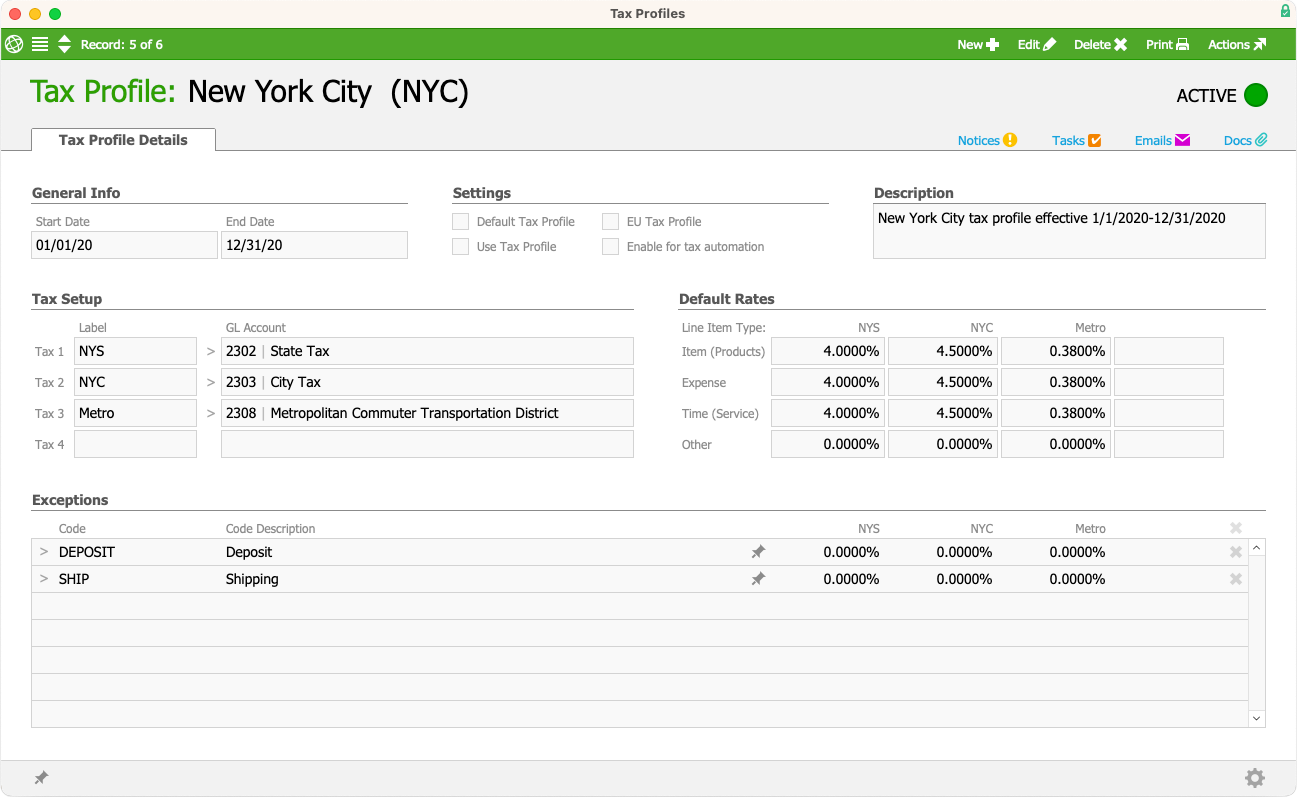

You can create, use, and update tax profiles for each desired location. aACE’s attention to detail allows you to capture any important and relevant information to your jurisdictions. Creating a tax profile means you can configure it as needed. An aACE tax profile includes: tax profile start and end dates, various categorization settings, related general ledger (GL) accounts, default rates, and any exceptions.

Tax profiles are linked to postal codes, allowing aACE to automatically calculate sales tax for an order using the tax profile tied to the shipping postal code. After you link a postal code to a tax profile, aACE begins to handle sales tax calculations on your orders immediately.

When it comes time to update your tax profiles, you can simply edit the tax profile record and make the needed updates. aACE will apply the updated tax profile only to new records within your aACE system, leaving past transactions unaffected.

aACE in Action: Creating a New Tax Profile

Suppose a company is expanding their sales and shipping into New York City. They need to set up a new tax profile.

The team meets to identify the jurisdictions involved. Using New York City government websites, they find that the overall tax rate for general merchandise is 8.875%. But this is divided across four tax entities: 4% for New York state (NYS), 4.5% for New York City (NYC), and 0.38% for the Metropolitan Commuter Transportation District (Metro).

A team member creates a new tax profile. They enter labels for the taxing entities and the corresponding GL accounts. They also enter the tax percentages and exemptions for products and services, then save the tax profile.

Location-based tax profiles is just one aACE feature that can help you manage sales tax. Read more about other aACE sales tax features, “Easily and Accurately Collect Sales Taxes with aACE+ Avalara AvaTax“.