Calculating required sales tax can be a chore with the wrong tools and solutions. Taxes can become more tricky when you do business regularly with tax exempt customers. Combine multiple tax exempt customers with several different shipping postal codes and you could have a complicated situation.

Using aACE’s tax profile feature, you can create a tax exempt tax profile and apply it to your specific tax exempt customers. This keeps your hands free while aACE automatically does the tax calculations for you.

Interface Spotlight

Tax profiles in aACE contain tax rates for a jurisdiction. They are manually entered by your team members and are typically linked to a postal code. Whenever a postal code is used on a record, aACE pulls the sales tax rates from the postal code’s related tax profile. However, tax exemptions work a bit differently.

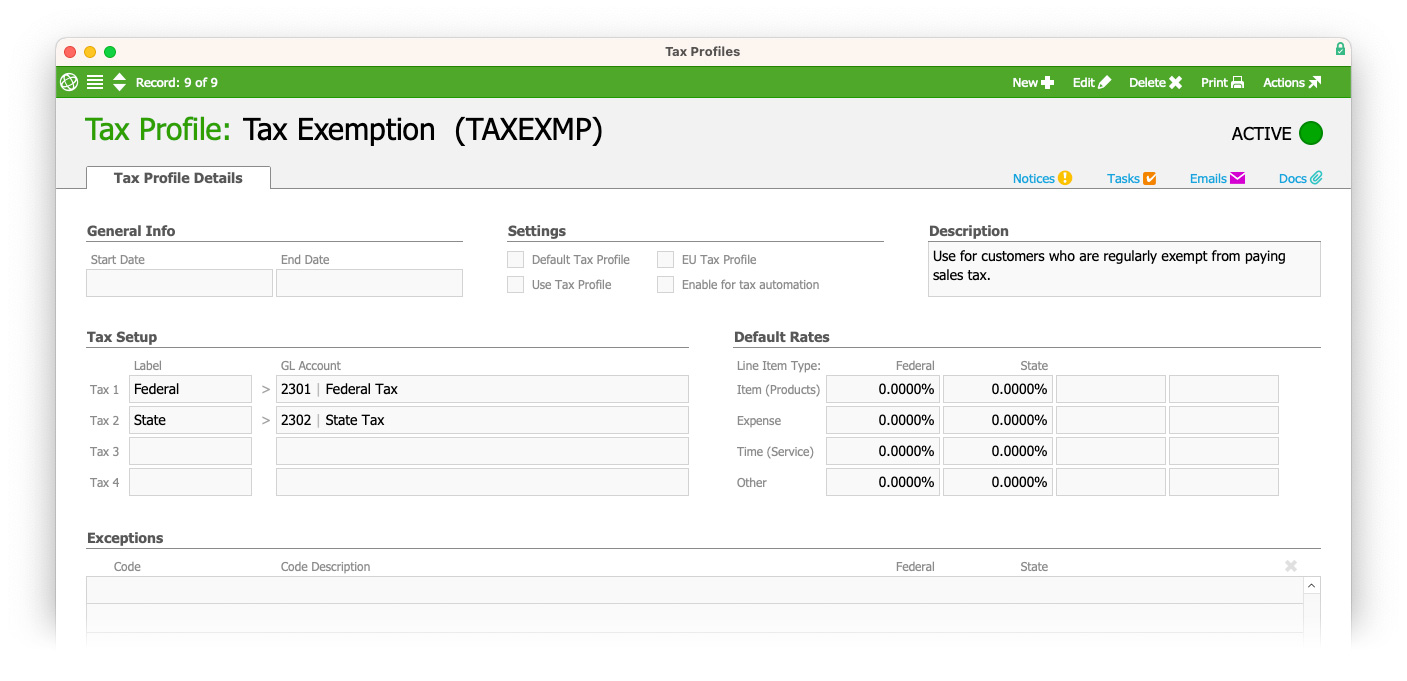

If you have customers that are regularly tax exempt (such as nonprofits), you can create a generic tax exemption tax profile for these customers. This involves entering any applicable tax rates as 0%.

aACE in Action: Tax Exempt Companies

Suppose a business has multiple tax exempt customers. A team member creates a tax exemption profile to apply to each of these customers. This profile can be linked directly to an aACE company record.

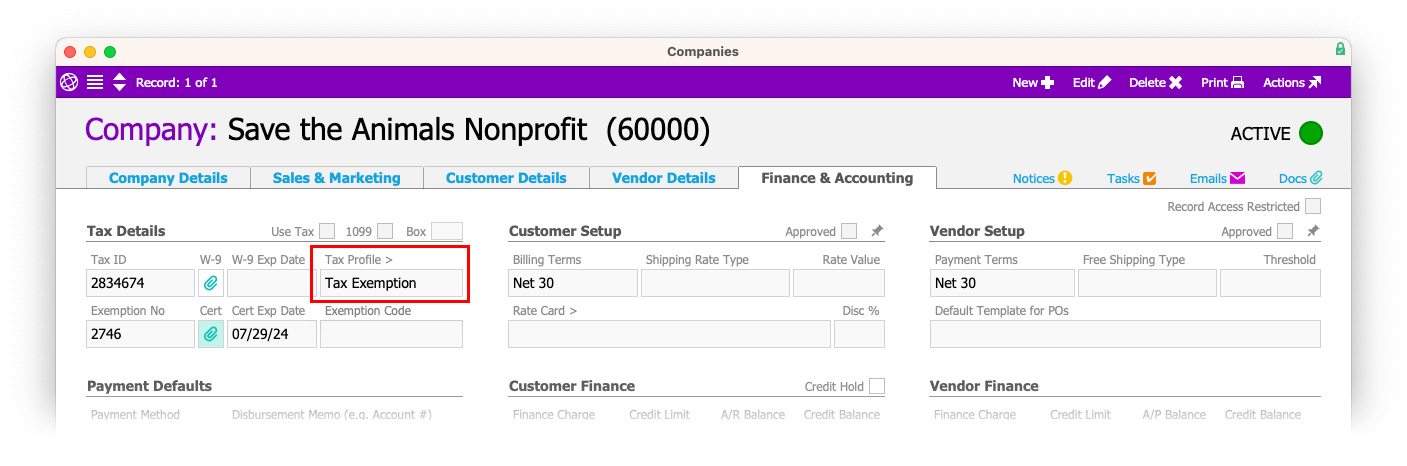

Linking a tax exemption profile tells aACE to override the system’s default tax profile for this company. Whenever a team member adds the company to a record, aACE will pull from the tax exemption profile instead of the system’s default tax profile associated with that postal code.

The team member navigates to a tax exempt customer’s company record. At the company record, the team member links the tax exemption profile to the customer.

The tax exempt customer’s company profile also has fields to conveniently enter and store all related tax exemption information such as the customer’s exemption number, exemption certificate, exemption certificate expiration date, and exemption code in one place. The team member enters and saves this information to the customer company record. aACE will now calculate the customer’s orders with the tax exemption details.

Specifying tax exempt customers is just one feature of aACE that can help you manage your sales tax. To simplify your sales tax calculation process, use aACE Tax Profiles to manage your sales tax.