Managing sales tax information can be a complex undertaking. aACE’s tax profiles allow you to enter sales tax information for each jurisdiction in which you do business. However, this information must be entered and updated manually. For complex business situations, too much time can be spent on tracking manual updates instead of managing your actual business.

This is where the aACE+ Avalara AvaTax integration comes in. AvaTax automatically calculates sales tax rates based on geolocation, item taxability, new legislation, tax regulations, and more so you don’t have to.

Interface Spotlight

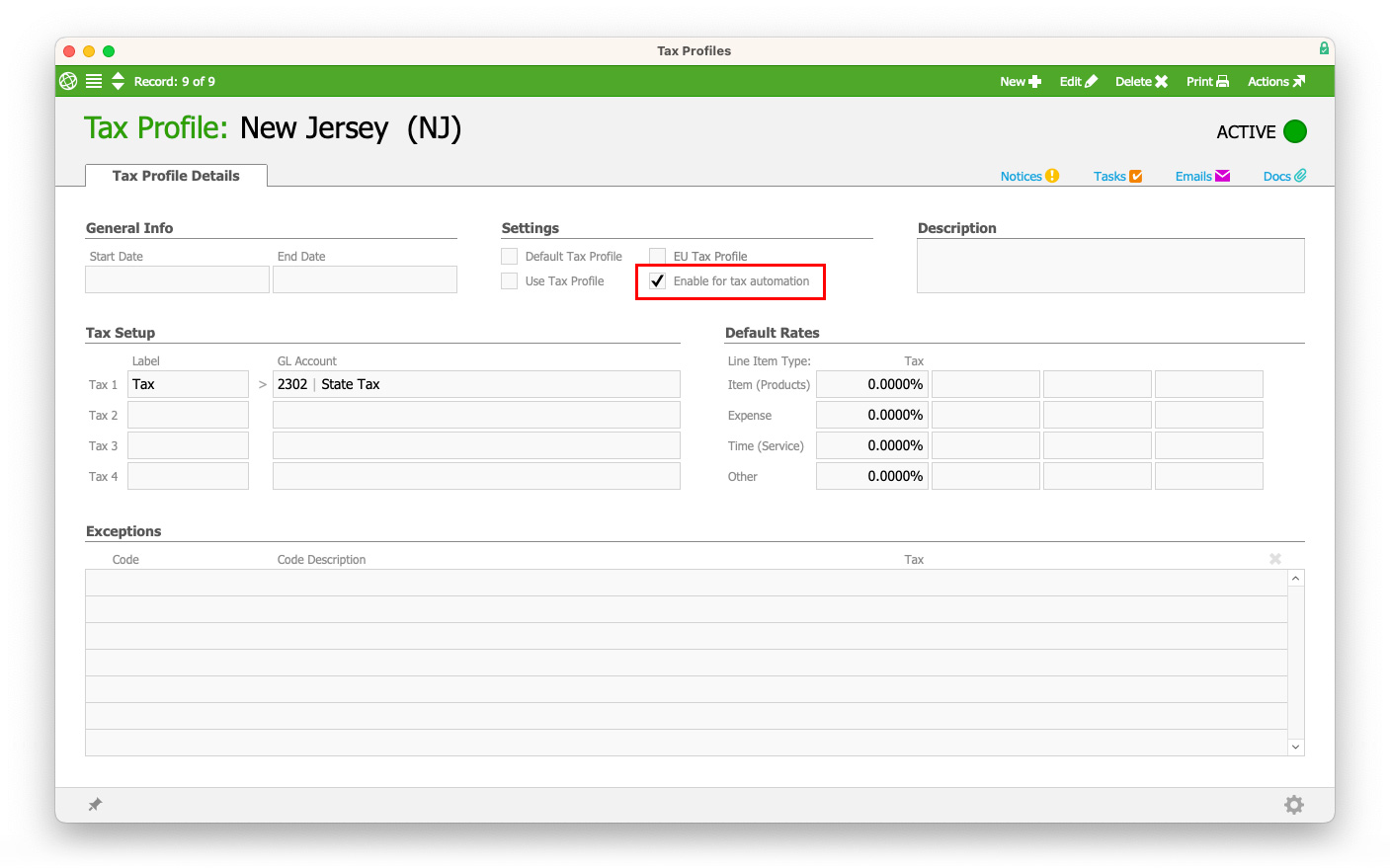

aACE’s AvaTax integration is applied at an aACE tax profile record. aACE tax profiles are manual entries of tax rates that are directly linked to postal codes. When a postal code is used on a record, aACE automatically applies the related tax profile and its tax rates to the record.

If a tax profile utilizes aACE’s AvaTax integration, the tax profile can be flagged as relying on AvaTax instead of manual tax entries.

When a tax profile is marked for tax automation—using AvaTax—aACE will automatically send AvaTax the record information whenever the postal codes linked to the tax profile are used. AvaTax then calculates the sales tax based on the proprietary geolocation linked to the record’s related address. You do not need to manually enter your jurisdictions’ tax rates or update them when needed. AvaTax does all the calculations for you.

aACE in Action: Using an AvaTax Tax Profile

Suppose a business enters a large order. The team member entering the order includes the shipping postal code for the order. aACE typically calculates sales tax based on the order’s shipping postal code. However, the team member will be using the aACE+ AvaTax integration instead of relying on manually-entered tax rates.

The order’s shipping postal code is linked to an aACE tax profile with tax automation enabled. Once the order is opened, this tax profile tells aACE that sales tax will be calculated using AvaTax. aACE then automatically sends the necessary information to the business’ linked AvaTax account for tax calculations.

The AvaTax integration is just one feature of aACE that can help you manage your sales tax. Explore more Feature Highlights about aACE Integrations.